QQQs +16bps at the beginning of a shortened holiday week - volumes slow to begin the week and should ebb the rest of the week. Yields plummeted following the announcement of Bessent for Treasury falling 10-14bps across the curve as investors took it to mean Trump' won’t be as hardline on Tariffs and Bessen seen more reasonable on fiscal issues. BTC fell 2% falling below $95 while Oil was down 3% below $70 again. IWM +1.5% big outperformance

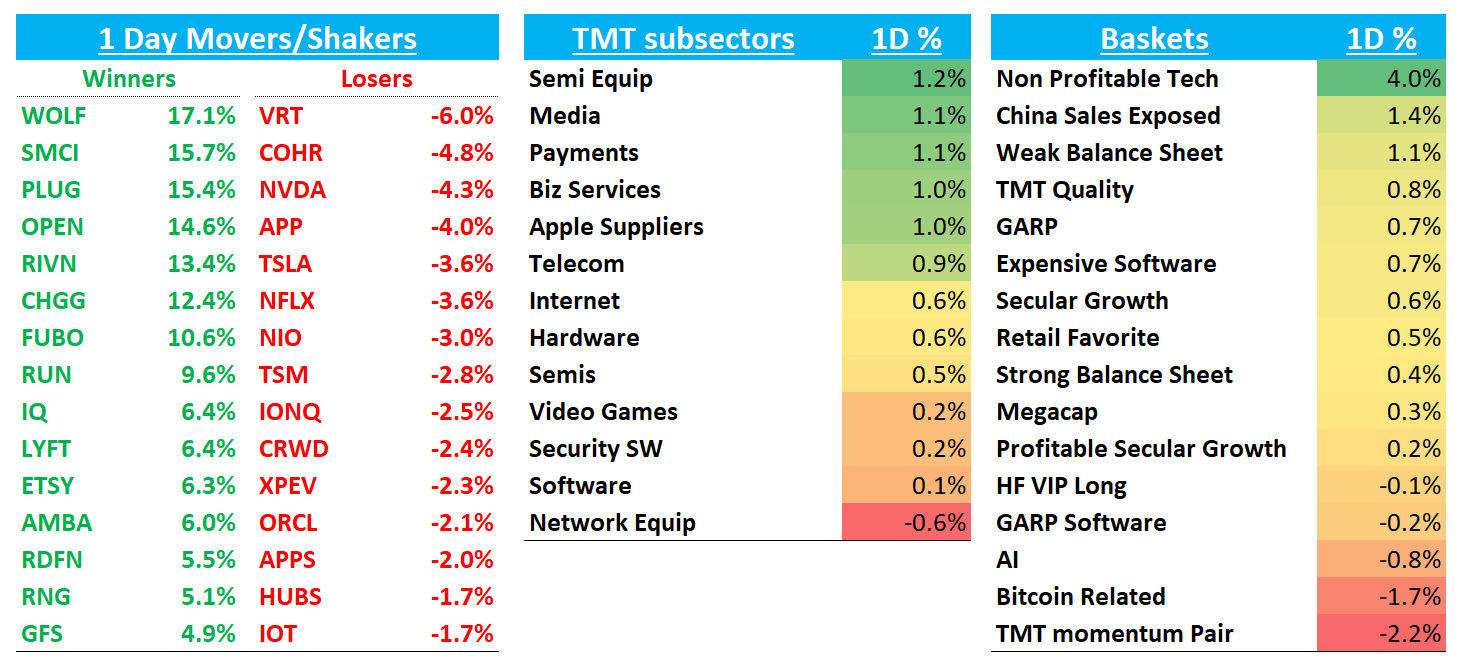

As has been the case over the past two weeks, the story under the surface of a flattish index tells a more complete picture. Non-profitable tech basket was +2% today while TMT Momentum Pair and AI/BTC names were down 1-2%+

In semis, laggards outperformed with a shift into analogs (ADI/TXN/NXPI/ON +2-4%), memory (MU +2% / WDC +5%), and AMD at the expense of YTD winner like NVDA -4%; TSM -3%; MRVL -30 bps.

If investors are selling NVDA to shift into smaller mid-cap stocks, while not bullish for the indexes, bullish for breadth. 5% of NVDA is $150B - if investors shift 5% out of there and those $’s find their way to SMID names, well I don’t need to spell out what that means. We liked this chart from GS’ TMT Spec Callahan this morning:

In software, seeing a bit of profit taking in the winners over the past several weeks. As we pointed out this morning after Ives’ upgrade of the sector, things getting a bit frothy in the short-term and we are heading into Dec where seasonality tends to be weaker (2nd weakest month vs Nov being the strongest month of the year). We get a slew of earnings over the next couple weeks starting with ZM today, then ADSK CRWD WDAY OKTA CRM GTLB among others.

Post-close ZM looks fine/inline-ish, although Q3 beat near low end of where buyside bogey was. FCF beat. Guide looks fine.

Q3 revs/EPS of $1.178b/$1.38 vs. Street at $1.15B/$1.3.

Q3 FCF $458M vs Street at $363M

Q4 Rev/EPS guide $1.775B/$1.295 vs. Street at $1.17B/$1.28

Increased stock authorization by $1.2b

Let’s get to the recap…

Internet

Housing names rallied as yields fell: OPEN +15%; RDFN +8%; W +9% while Z lagged +68bps

NFLX -3.5% had some scratching their heads today. Some will say laggards selling off contributed but that didn’t seem to be the case in internet. I have another theory. Last week we saw NFLX rally Monday and Tuesday before 3p data came out on Wednesday showing a big spike in gross adds because of the Paul v. Tyson fight. Lots of Hedge Funds have their own internal alternative data teams that many times “front-run” the wider release of alternative data reports from the likes of Yipit/M-science. My guess is that data is now showing that churn has spiked somewhat as some of those new members cancel their plans. Just a total guess here, but wouldn’t be surprising to me. We’ll see if the 3p providers say something similar - Yipit usually releases their weekly NFLX report on Wed.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.