TMTB EOD Wrap

QQQs -40bps after being close to +1.5% at one point — price action continues to point to more digestion as we’re now in the toughest seasonal period of the year over the next month and half.

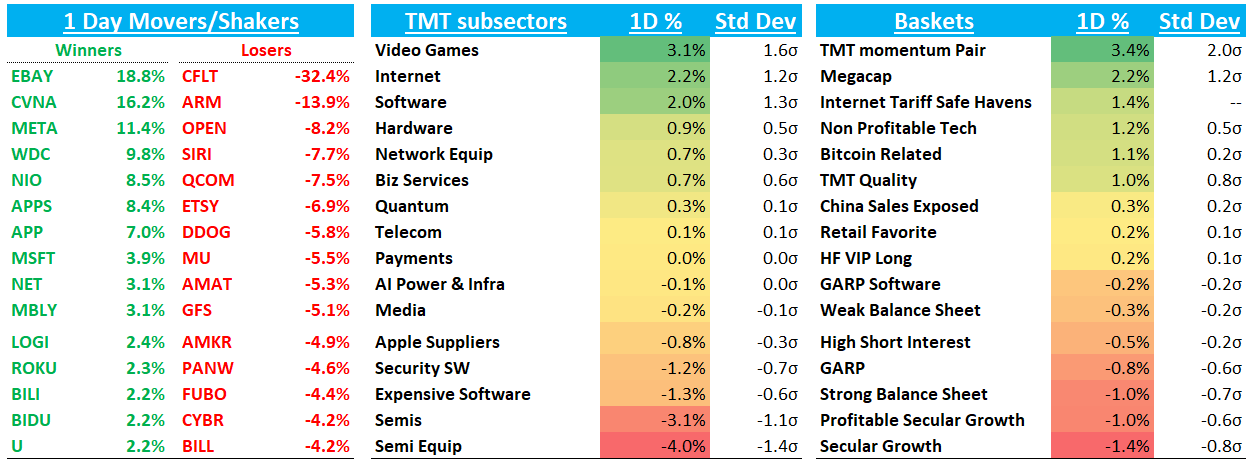

Bad news continues to be sold hard — just take a look at CFLT -32%, ARM -14%, COM -14%, or MU -5% among others today. Positioning & sentiment continue to play a more than average importance this earnings season — just take a look at the difference between META +12% where intra-q positioning skewed short given opex fears among the fast money crowd vs. the more long-crowded RBLX +9% and MSFT +4% fading on unarguably great prints as well. Read-throughs are acting similarly with AI semis not acting as well as one would expect given the capex guidance from MSFT/META and TI reporting that OpenAI $12 Billion in Annualized Revenue, breaking 700 Million ChatGPT WAUs— shows that even the AI trade is taking a big of a breather after what’s been a non-stop Hot AI Summer party. Rainy days Digestion can be a good thing in the hottest of summers.

Positioning/Sentiment is mattering more on good news vs. bad however — bad prints are just being sold regardless — especially if it’s a bad quality company - regardless of positioning. That continues to skew the r/r to the downside this earnings season, as has been the case over the last several weeks.

Some beats are even following through to the downside. Check out NOW breaking down:

Or NFLX:

We’ll stick to what we said earlier this week:

We all know the markets have been very frothy the past couple months and now we are seeing stocks going down on good news

(outside of AI semis) in the face of the seasonally weakest period for stocks. Adjusting net/gross/sizing somewhat doesn’t sound like a bad idea…focus on the highest quality/conviction ideas

We get a slew of earnings this afternoon from AMZN RDDT NET AAPL and COIN. Should be a fun end to an exciting week.

Let’s get to it…

INTERNET

AMZN +2% as price action today has some worried given lack of follow through on some big beats (AMZN positioning skews more long than META was into the print, although maybe a tiny bit less than MSFT…GS has it at a 7 out of 10. I’d say prob say closer to 8 out of 10). AWS estimates probably ticked up overnight now closer to 17.5-18% vs the 17% going in before the Azure print.

META +11.5% on one their best prints in years as Zuck backed up what he has been telling new recruits: our business model rocks and we can fund as much compute as you want. We wrote our thoughts this morning here … GOOGL -2% as some unwinding of the L GOOGL / S META trade

RBLX +9%: Even long-time stubborn bear Doug Creutz at Cowen had to admit in the title of his note “That was pretty impressive".” Q2 bookings crushed at 51% y/y and non-GAG games grew +36% helping put a nail in the one-time hit bear case. Mgmt was adamant GAG’s hit status enhanced the success of other games rather than hinder it as 2nd tier games grew 90% y/y. Q3 Bookings +41% at a minimum much better than expected and while Q4 bookings guide implies a decel, we think its just mgmt being overly conservative and think its possible bookings could grow 50% 3 straight quarters. Yes, we all know comps get harder in CY26, but that’s a story for another time. In the meantime, stock continues to get re-rated higher. It’s a similar story to what happened to CVNA over the last several years where the shareholder base/perception of stock did a 180 — RBLX is no longer a 3p data tracking stock, but investors are appreciating the more durable nature of tailwinds. And that’s not to mention most tailwinds haven’t even really ramped: SHOP partnership, GOOGL Ad partnership, AAPL app store chg tailwinds, AI vibe content creation, IP License Manager, etc.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.