TMTB EOD Wrap

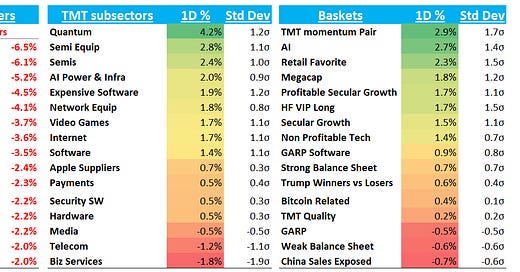

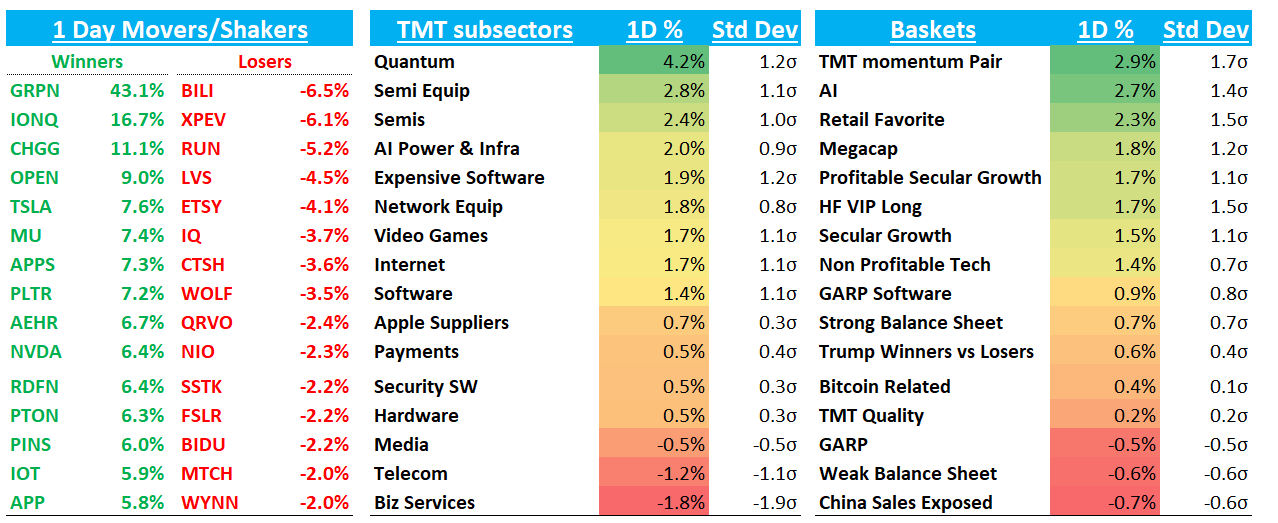

QQQs +1.1% as a softer CPI print helped Semis +2.5% outperform. Some healthy action in names today as fundamentals slowly try to gain a foothold - favorites at great r/r levels like META NVDA AVGO and MU outperformed. Mo, AI, and Megacaps led the way higher. Yields finished up 2-4bps.

Let’s get to it…

Post-close:

ADBE -4%: Total revs a touch better and reaffirmed FY25 targets but Digitial Media ARR growth a little light of bogeys at 12.6%. Q2 guided roughly in line with street on top line although EPS guide of 4.95-5.00 a touch below street at $5. Call ongoing and will need to see what they say about AI products ramping..

ADBE RESULTS: Q1

- ADJ EPS $5.08 vs. $4.48 y/y, EST $4.97

- Revenue $5.71B, +10% y/y, EST $5.66B

- Digital experience revenue $1.41B, +9.3% y/y, EST $1.4B

- Subscription revenue $5.48B, +12% y/y, EST $5.42B

- Product revenue $95M, -20% y/y, EST $95.4M

- R&D expenses $1.03B, +9.3% y/y, EST $1.01B

- ADJ operating income $2.72B, +10% y/y, EST $2.66B

- Services and other revenue $136M, -7.5% y/y, EST $144.3M

GUIDANCE: Q2

- Guides ADJ EPS $4.95 to $5.00, EST $5.00

- Guides revenue $5.77B to $5.82B, EST $5.8B

- Guides digital media revenue $4.27B to $4.30B, EST $4.28B

- Guides digital experience revenue $1.43B to $1.45B, EST $1.45B

- Guides Digital Experience subscription revenue $1.32B to $1.33B, EST $1.33B

PATH -15% - Bad print as 4Q in-line, but guiding well below: 1Q ARR to 11% vs cons +13%. Guiding to 10% ARR growth for FY25, below street at 13-14%

$PATH GUIDANCE: Q1

- Guides revenue $330M to $335M, EST $367.4M

- Guides annualized recurring revenue $1.69B to $1.69B, EST $1.71B

RESULTS: Q4

- Total revenue $423.6M, +4.5% y/y, EST $424.9M

- Subscription revenue $215.2M, +22% y/y, EST $210M

- License rev. $197.6M, -10% y/y, EST $205.1M

- ADJ EPS $0.26 vs. $0.22 y/y, EST $0.20

- ADJ operating profit $134.0M, +21% y/y, EST $100M

- ADJ gross profit $370.4M, +2.9% y/y, EST $366.3M

- ADJ gross margin 87% vs. 89% y/y, EST 86%

S -13%: BofA: “4Q financials relatively in-line, but ARR of $920.1mn missed St at $921mn, and then guiding 1Q and FY26 below. Guiding to 1Q Rev growth of 22.3$ vs cons 26.4% & FY growth of 22.9% vs cons 25.7%.”

Internet

SPOT +5.4% as they signed Bill Simmons podcast to a $250M deal

PINS +6% as Clev had a positive note out saying Performance+ adoption increasing suggesting meaningful uplift of >10% ROI after last week saying that new DSPs are in the process of ramping. Warmed up to it on r/r last week, but with checks now coming in better and catalysts in new 3p partnerships, I like it even more.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.