TMTB EOD Wrap

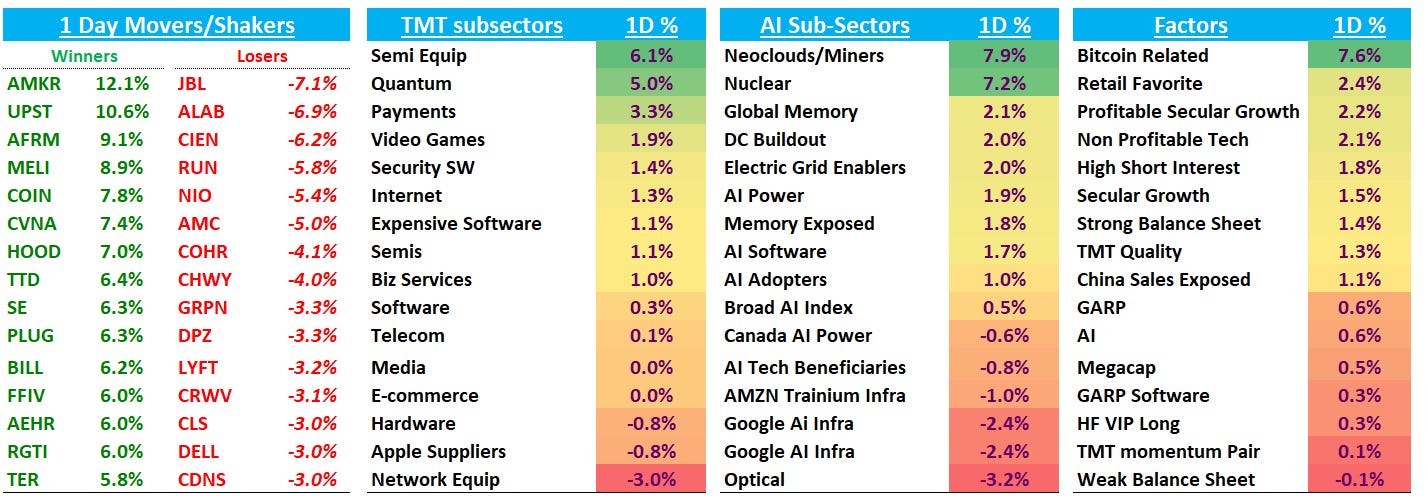

Good afternoon. QQQs finished the day +80bps as today saw clear factor and subsector dispersion. Strength skewed toward higher-beta and rate-sensitive areas—Semi Equipment (+6.1%), Quantum (+5.0%), Payments (+3.3%)—while Network Equipment (-3.0%) and Optical (-3.2%) lagged, weighing on names like CIEN and LITE. AI exposure bifurcated: power, grid, and nuclear themes surged (Nuclear +7.2%, Grid +2.0%), while Google-linked AI infra and optical AI sold off. Outside of Tech, cyclicals rallied, including financials, capital goods, energy, and autos, along with consumer/retail. IWM outperformed QQQs by 80bps.

Treasuries saw gains with yields falling 3-4bps across the curve although Fed expectations didn’t shift much in either direction. Powell replacement options continue to be neck and neck between Hassett and Warsh, both around 40%. BTC +3% to $95k.

Good to be back. Lots to get to, so let’s get to it…

INTERNET

MELI +9% / SE +6% as Shopee is increasing its Brazilian take rate for individual sellers (CPFs) as of tomorrow….increasing the fixed fee to $$7 per item from R$4 earlier for individual sellers. The key change for MELI is that below SE was ppricing below MELI on most items, now Shopee is charging above MELI in items up to R$78, while still below MELI on higher priced items. Bullish read here is rational competition and moderation in Shopee’s competitive appetite. MELI also slightly benefitting from the situation in Venezuela - as recently as 2016, Venezuela was a MSD contributor to MELI’s revs (close to 20% back in 2013), which has since dropped to 0. So any bounce back would be beneficial.

TTD +6.5% as Guggenheim reitterated buy and called out management changes and potential incremental drivers—such as international expansion and new platform initiatives—as catalysts that could help restore confidence and drive revs above street, which has them growing mid teens

ROKU +5.5%: several pieces of good news here this morning. Wells made a 2026 tactical pick, expecting platform growth to stay strong into 1H26 and get an added lift from a record mid-term political ad cycle and the World Cup in 2H26, saying 12% platform growth in 2026 (where street is at), is way too conservative. They think initial EBTIDA guide could come in 15% above street. Arete also upgraded for similar reasons, although called out AMZN’s integration as most important catalyst. The firm also believes Roku can unlock incremental value from The Roku Channel by shifting a portion of ad monetization toward 1P SVOD revenue via the Frndly and Howdy assets. Finally, Hedgeye was also positive, saying something similar: Roku is an under-monetized CTV operating system that Hedgeye thinks can keep platform revenue growing high-teens (vs Street’s low-teens), layer on new demand from Amazon/retail media and performance ads, and expand EBITDA margins to >20% with >$10 EPS by 2030. They think on that framework, stock is $200+…One of best charts in TMT (we love multi-year breakouts)

AMZN +3% reversing Friday’s dismal performance, as ISI was out positive on Rufus saying Rufus could lift retail GMV by up to $56bn (~4.4%) and ads revenue by ~$4.8bn (~3%) by 2028. META +1.3% with GOOGL +40bps and NFLX +50bps bringing up the rear in large cap land

RBLX +11bps continues to be a somewhat crowded short among Hedge funds despite bookings tracking slightly ahead of street — short/medium term narrative is tough here with tougher comps beginning in a few months and then you run in GTA VI stealing engagement in the fall. However, it just takes a big viral hit to flip this script but for now that’s where it is.

RDDT +90bps as Piper was positive saying they think GOOGL/OAI deals could be reupped by summer ‘26. Also announced max campaigns (AI) today, which they say early testers saw 17% lower CPA and 27% more conversions on average. US DAUs continue to track above street and checks were solid to end the quarter — hearing SMI & ODP data finished strong. Still think prob a B/B+ here

DUOL +5% as BofA upgraded to buy arguing the market is overly framing DUOL as a pure education app and missing its broader entertainment-style engagement and dual-TAM opportunity. BofA notes the company’s gamified mechanics—such as streaks, rewards, and short-form challenges—make it resemble a leading mobile gaming platform, opening up a roughly $120bn mobile gaming adjacency on top of its ~$127bn core language-learning market.

CHWY -4% — didn’t see much here

SHOP +5.5% although downgraded by Wolfe post close citing valuation

AI / SEMIS

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.