TMTB EOD Wrap

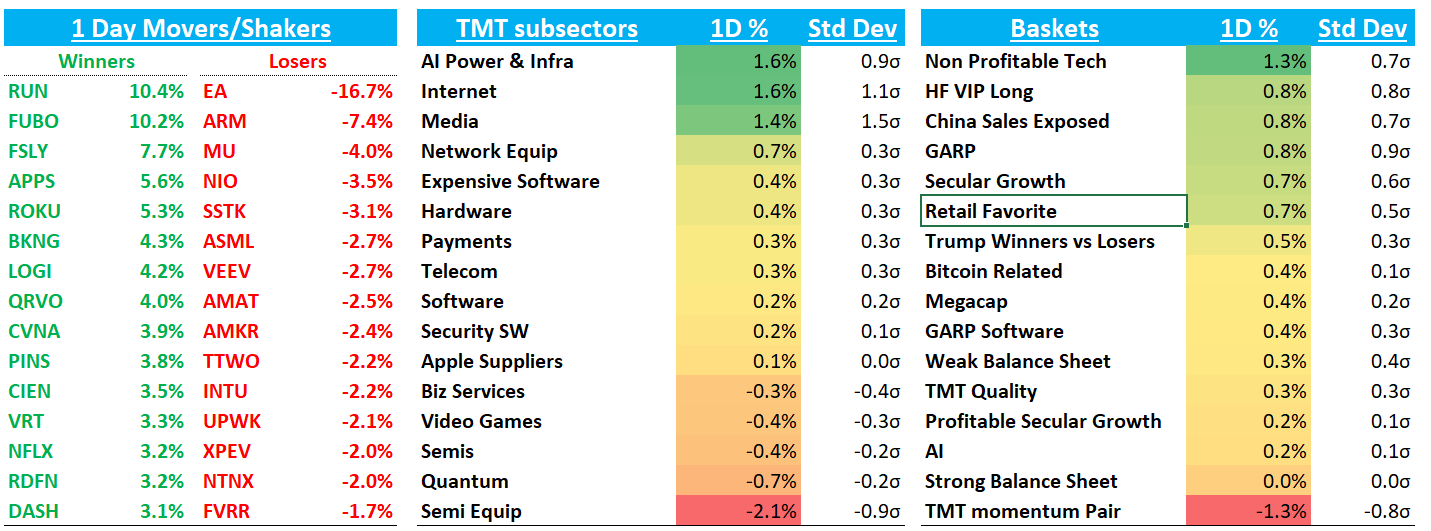

QQQ +20bps - semis finished down while strength in Internet and AI Power led the way higher. Early weakness in Stargate like ORCL +1.2%; MSFT flat; and NVDA +10bps ended being bought up — just another sign how price action decidedly more positive now vs. early last week. Despite the slight up day, lots of names up 1%+ on my screen.

Trump was at Davos calling for OPEC to lower oil prices, central banks to lower interest rates and reiterated stance on slashing taxes and regulation. Talked up relationship with China. BTC -1.5% recovered some gains as Trump tea leaves mean he might buy BTC. The 2 yr dipped slightly while 10 year rose 3bps. Fed expects continue to hold stay with 40bps worth of cuts priced in for 2025..

Post-close:

TXN -3% as Q4 inline/beat. Q1 looks inline vs street but slightly better than buyside. Overall looks fine and just giving back some gains from today.

TWLO +10% after better guidance at their analyst day with prelim Q4 guide at 11% vs street at 8%, ‘25 Op inc of $825-$850 vs street at $820, $2B buyback, 21-22% OM guide for FY2027 vs street at 19% and $3B of cum FCF ‘25-27

Let’s get to the recap…

Internet

NFLX +3.2% back to around where it opened yesterday after Wolfe upgraded saying results “buried” long standing concerns about a deep slowdown after ‘23/’24 barrage of password sharing interventions.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.