TMTB EOD WRAP

QQQs +70bps as risk on continues. The strong get stronger is the message across Tech as winners continue to display sustained momentum — this is happening across all sectors but markedly in sw (NET, SNOW, MSFT, etc.) and internet (SPOT, NFLX, RBLX, META, etc.). Yields perked up again today with the long end of the curvev up 5-6bps. China +1%. BTC lagged -1%.

Let’s get to the recap…

INTERNET

GOOGL -1.6% as reports that Samsung is replacing Gemini with Perplexity in most devices. GS was out positive as well saying YouTube is worth ~$475B and Google Cloud ~$710B, implying the Search & Other segment is currently trading at just ~5.3x FY26E EBIT…next big datapoint is Yipit data on Friday which will encompass 3 weeks and likely will set the tone going into the end of the q

META +4% as WSJ reported they aim to full automate ad creation using AI, which means less $’s go to ad agencies and more money for to spend on advertising - good for META. Investors liked the news as supports bull case all the capex $ META is spending is driving improving ROI

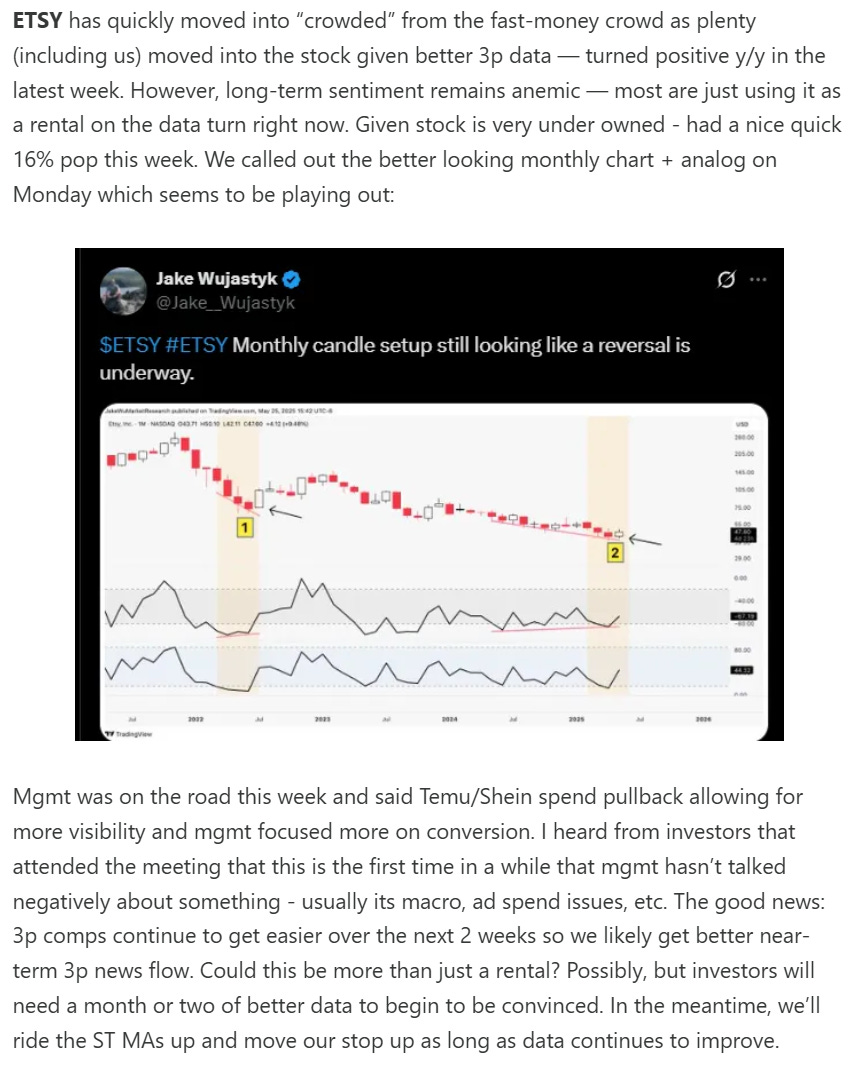

ETSY +6.5% following through on last week’s Yipit data. We recapped in our weekly yesterday:

BofA was also positive saying ETSY DAUs accel’d 4 ppts in May

RBLX +3.3% as Wells Fargo confirmed what we have been hearing from 3p data: concurrent user growth is off the charts, reaching as high as 80% y/y in May driven by Grow a Garden which now accounts for 20% or RBLX avg CCU…$100 beginning to act like a magnet here

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.