TMTB EOD Wrap

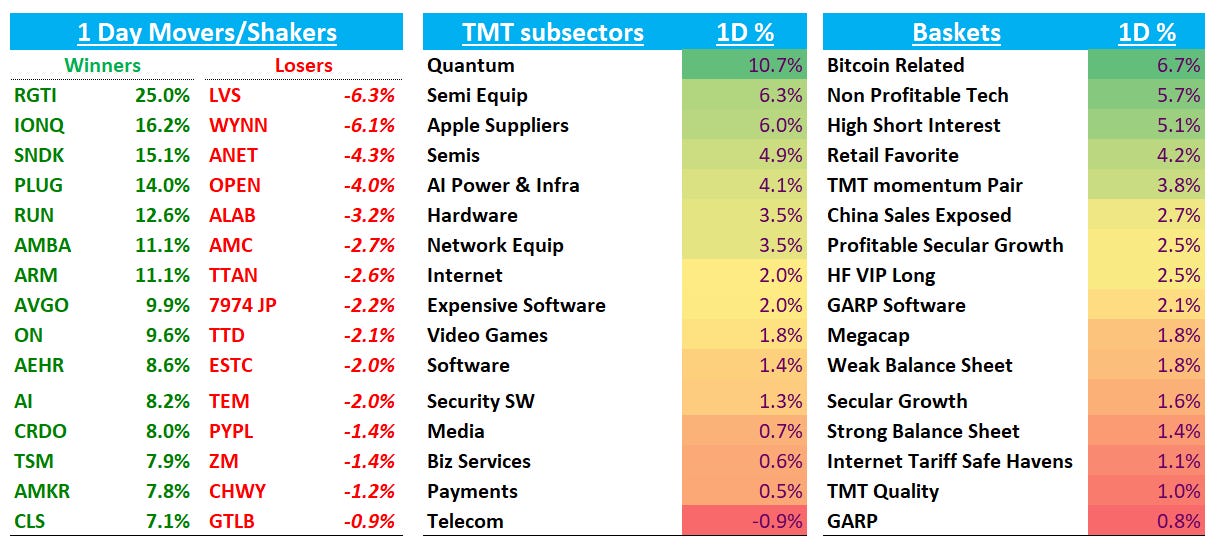

QQQs +2.1% recouping some of the Friday losses after Trump, Bessent and China did their best to assuage investors that things wouldn’t escalate from here. The AI trade was back in full force as OAI announced a 10GW deal with AVGO (more on that below).

Let’s get straight to it…

SEMIS

AVGO +10% as they announced a 10GW deal with OAI, similar to announcements by NVDA and AMD in the last month. AVGO’s agreement includes rack-scale systems designed by AVGO beginning to be deployed in back half of 26 and extending through end of CY29. Seen early numbers thrown around that AVGO could get ~$15B+/GW for this deal, which means $3-5 share in FY27 (street at $12 and buyside closer to $16). So pretty big numbers if you believe it.

AVGO president was also out saying mystery $10B customer isn’t OAI - heard some speculation that possibly xAI and MS Tech spec was out saying the origialn $10B order could be Antrhopic for GOOGL TPUs made by AVGO given recent reports that Anthropic was shifting workloads from AWS to GOOGL Cloud + TPU

Lastly, was also initiated Buy at Alethia with $400PT

OpenAI x AVGO Podcast with Greg and Hock here … definitely worth a listen

Full interview with new ORCL CEO on CNBC here

Memory continues to rip with SNDK +15% to new highs and MU +6%. Cleveland and Edgewater were both out positive on SNDK and MU saying pricing should continue to ramp in ‘26 as hyperscaler demand continues to surprise to the upside. The AYZ article on Memory worth a read to get you bulled up, with the key takeaway as follows:

Looking ahead to 2026, if our estimation is correct and GPT-5’s token processing volume doubles again next year, its DRAM and NAND demand will reach 18.26 EB and 400 EB, accounting for 43% and 39% of the total DRAM and NAND supply in 2026, respectively! In other words, if global DRAM and NAND manufacturers still fail to fully grasp the explosive growth in memory demand brought by LLMs, and continue expanding production based on the traditional upcycle pattern of roughly ~20% capacity increase per year, this will lead to severe supply shortages in the memory industry in the following years.

Therefore, we believe that the memory upcycle driven by AI large language model demand, which started in the second half of this year, is likely to become a memory supercycle, with the price uptrend lasting not just for a few quarters but possibly a few years.

I’m hearing buyside near $15 for SNDK FY’27 (vs street at $10.3) and $24 for MU FY’27. So while these stocks have ripped, still don’t look that expensive if memory cycle continues and if you buy into argument stocks should trade at higher through cycle multiples than previous cycles given this AI “supercycle” is different with more visibility on demand. We prefer Samsung over MU for reasons we’ve discussed previously, but by no means would we put that pair on. Posted this before, but SNDK thesis boils down to this, summarized well by a TMTB reader:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.