Just a quick note: Please pass along color and notes you get from sell-side calls throughout the day. I usually don’t have the bandwidth to get to most calls — if we can crowd source as a group, I think it would be beneficial to everyone (especially in this macro environment). I know some are hesitant to post on TMTB chat, so feel free to DM me or on X, or send me an e-mail at tmtbreakout@gmail.com. I will always ask you if it’s ok and how to pass along to the group, and most importantly always keep your anonymity.

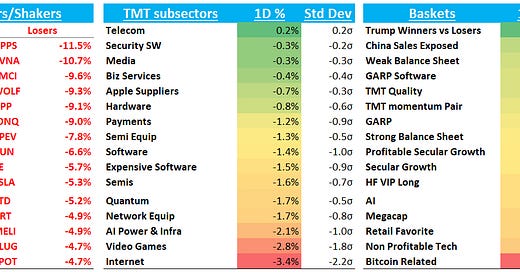

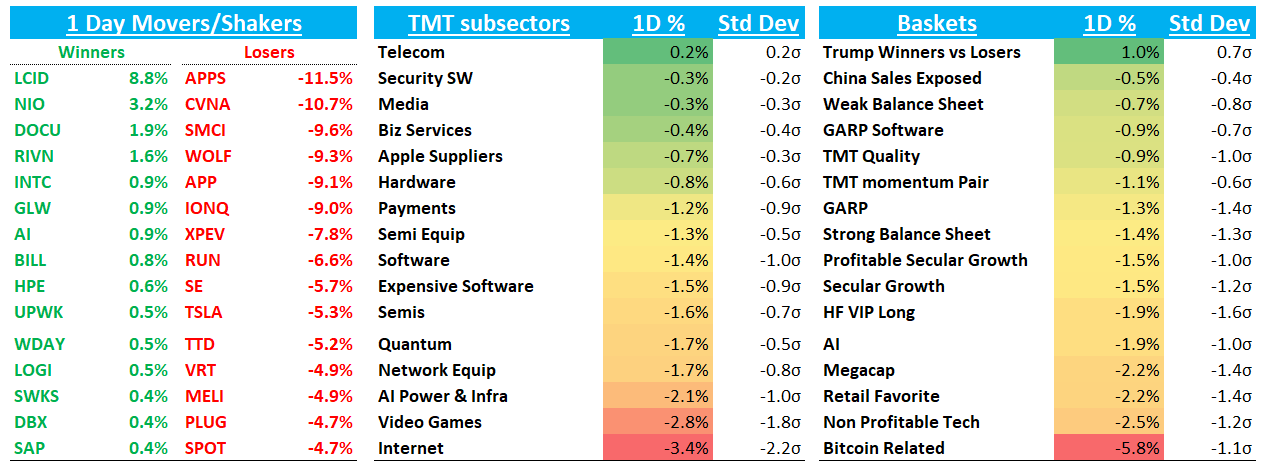

QQQs -1.7% giving back all of yesterday’s gains and more as Megacap was weak again today. No big headlines today, either from Trump or Jensen, but the market continues to be skittish ahead of the 4/2 Tariff date. All eyes on the Fed and Powell tomorrow as yields finished flat to up and fed expects held steady at 60bps worth of cuts for the year.

Jensen’s keynote (replay here) was fairly as expected (more details below). Analyst day with CFO is tomorrow at 11:30am as investors focus on any demand or GM trajectory commentary.

Internet

Ad names weak today as we’ve heard incremental ad checks over the last week start to call out macro headwinds. The ad business is after all a cyclical one.

RDDT - 12% the big loser — didn’t see anything incremental, but just think more follow through as investors digested the Redburn sell initiation that we wrote about yesterday. Key quote there: “third-party data also shows subsequent larger and more prolonged dents in late January and mid-February.” While traffic has rebounded, I think the fact that more Google algo volatility occurred in Q1 is worrying investors about trajectory of DAU growth going forward.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.