TMTB EOD Wrap

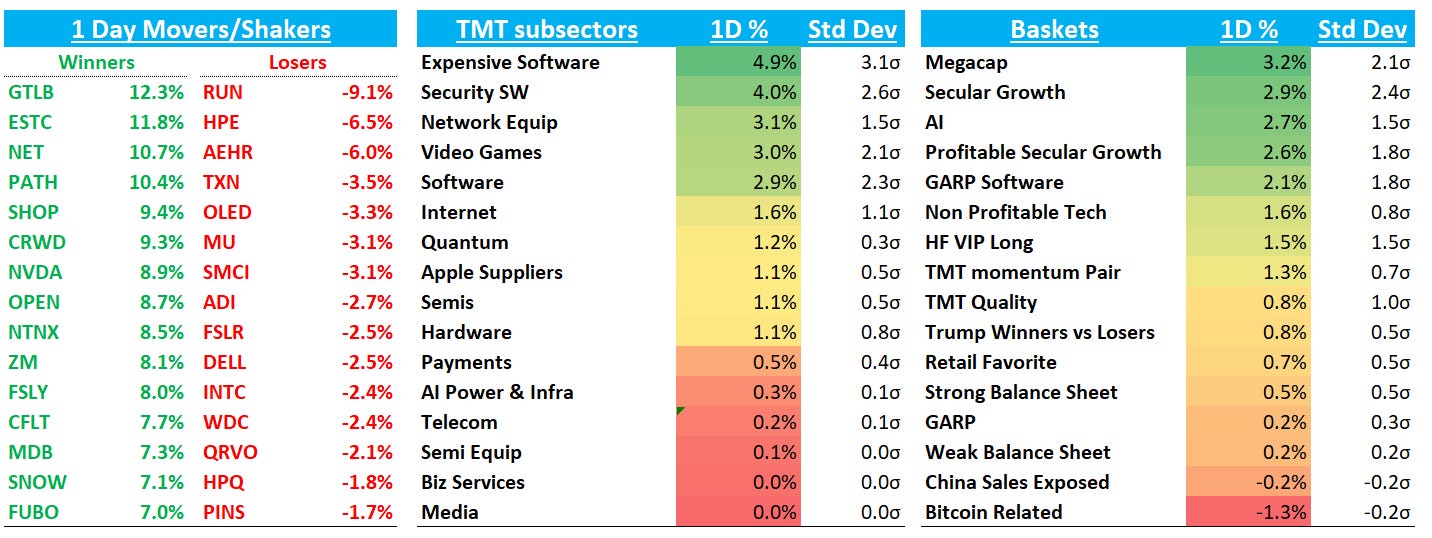

QQQs +1.5% as tech staged a nice comeback following yesterday. Software +2.8% continued to lead the way with many names +5% as investors coming away incrementally more bullish on software after the last few days. Model improvements → lower inference costs → more data (good for cloud consumption players, NET, FSLY, etc.) and lower prices for AI Agents → more demand + faster adoption of products → more revenue and better margins.

In semis, NVDA +9% staged a very formidable bounce back day. Yesterday, despite a lot of chatter of Jevon’s paradox, I felt like many investors wanted to digest the news before stepping in. Today, sentiment felt better as talk shifted to timelines getting pushed up, including the holy grail of robotics coming sooner. Most of the sell-side was out defending today saying this will all lead to more compute and that industry contacts so far saying Deepseek has not impacted the capex planning process (to give you a sense of interest - MS’ Deepseek call this morning had 4,700 people on it). Altman was out this morning saying this all means more compute, and others at OAI followed saying similar things.

There was continued debate about what Deepseek means for ASICs (MRVL/AVGO) vs. Merchant solutions like NVDA (see below for more)…

Next big data points are MSFT and META tomorrow.

META +2% continues to lead large cap internet although GOOGL +1.8% and AMZN +1% fared well today too.

A fun couple of days. Lots of shifting narratives. Lots of big moves in liquid, large cap stocks. I wrote this a couple weeks ago in our weekly to start the year:

Most important of all: we continue to think 2025 will require us to move our feet quickly, adjust priors with little hesitation, and not be afraid of changing our minds when need be.

I think this is just the start and we’re likely to see many more shifts going forward. This AI cycle is unlike anything anyone has ever seen before — it’s not only going up fast, but it’s also zig and zagging faster than anything I’ve been part of. That means be prepared for more shifting narratives. For example, software is strong right now but be ready for the inevitable “SW AI Agents going to cannibalize seats and AI will make sw redundant” shift. There’s a reason we called our bullish view on software a “3 to 6 to 9 month golden window.” For now: we’re in the clear as better sentiment and initial ramp of AI Agents likely to outweigh any concerns around seat impact. Point is: stay on your toes. We think that makes for a fun and opportunistic investing/trading environment, but it also requires being flexible/moving quickly.

On the macro front, yields jumped to start the day but reversed and finish flat. The market is now pricing 50bps worth of cuts from the fed this year. We continue to think the macro environment is supportive of owning stocks and seeing plenty of names break out to 52wk highs which tells us market wants higher. Fed is tomorrow and PCE on Friday - we think inline-ish results is all bulls need to keep grinding.

Semis

NVDA +9% vs MRVL +3.5% / AVGO +2.5%. One of the key debates emerging from this is the competition between ASICs and merchant solutions like NVDA…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.