TMTB EOD Wrap

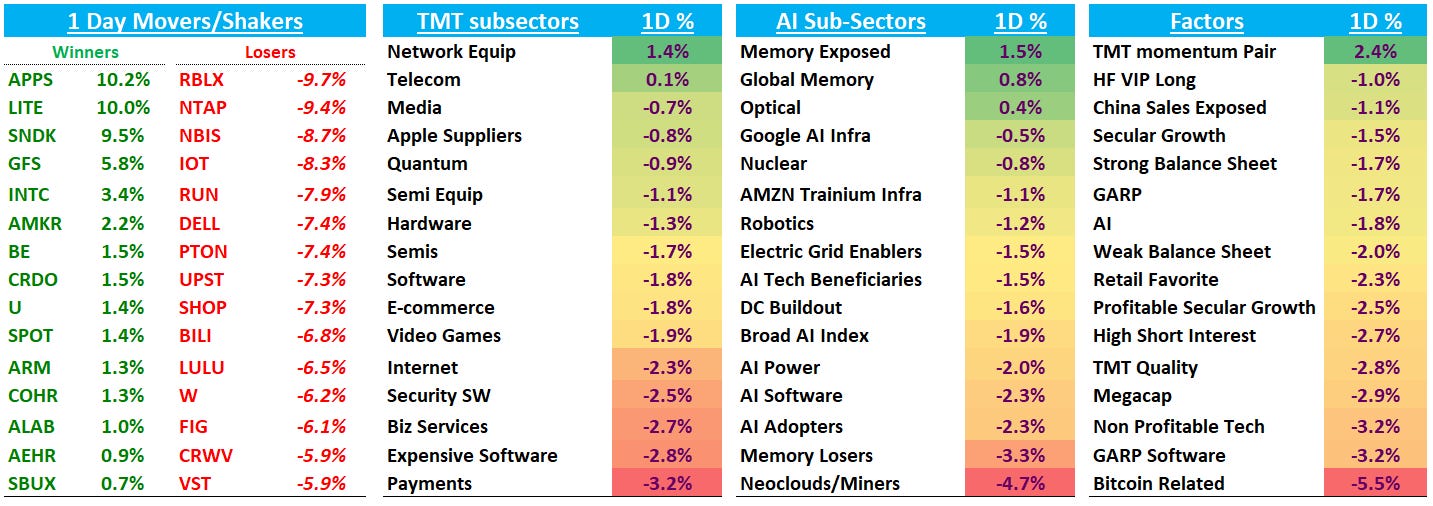

QQQs -2% breaking below 10d/20d on an ugly day in Tech although there were some pockets of green mainly concentrated in the usual areas we’ve gotten used to over the past couple of weeks (Memory, Optical). IWM continues to outperform the QQQs, this time by another 90bps. Yields rose 6-8bps across the long end of the curve while BTC dipped below 90k. A TMTB reader lays out the reason for the sell off succinctly in the chat:

VK put it well this afternoon: The fact these macro headwinds occurred at a time of rich valuations and complacent sentiment (as detailed in the latest BoA survey) added to the session’s gloom (stocks just don’t have much technical aircover to absorb macro blows).

In general, hearing most hoping for some TACO but unclear we get that in the immediate future. Outside of memory/storage, optical and few areas here and there not a lot of good looking charts in Tech right now.

Within tech we saw sharp dispersion today, with single-name volatility overwhelming the tape. Network equipment and memory-exposed names led on the upside, while optical also held in the green despite broader AI weakness. In contrast, semis, hardware, and software all sold off in broad risk off action. Neoclouds/miners the worst-performing pocket in AI. From a factor perspective, momentum pairs worked, but megacap, quality, bitcoin and profitable growth underperformed.

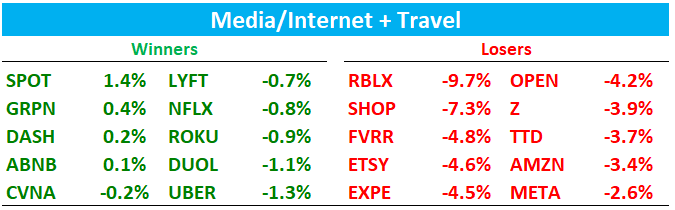

After the close, NFLX -5% with slight EPS upside driven by a small beat on top line while margins came in at 24.5% vs street at 24.3%. Engagement improved vs 1H but remains muted (+2% y/y in 2h despite a huge slate). Guide slightly above on street, but 100bps below on street (31.5% vs street at 32.4% although includes some one time acquisition expenses). I didn’t get a chance to dig into the call yet, but feedback from others was that mgmt didn’t do a great job explaining slowing engagement. Main overhang here continues to remain the WBD deal and no one excited to jump in here.

Not a ton to call out on an idio basis on what was broad risk off, but let’s get to it…

INTERNET

RBLX -9.5% as overall data was slightly down w/w and DB cut PT. This is a fast money/data heavy stock which got crowded real quick so not a huge surprise on the sell the news action here

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.