TMTB EOD Wrap

QQQs -13bps — again the story under the surface tells a more complete picture than the indexes. As has been the story since Trump (and before), semis continue to struggle, now below 10d/20d/150d:

Lack of strength all around. A talk like Jensen and Masa would have been good enough for a 3-4% rally just a few months ago for the AI semi group. NVDA barely budged over two days. And other AI semi stocks down 4-5% over that time period. We’ve mentioned some important levels in AI leaders and while NVDA is still above previous highs of $140, MRVL above $85, ANET above $375, and VRT above $110 TSM looks to breaking down a bit on fears around Trump Tariffs (recall TSM was one of first semis to break out to new highs following Oct. earnings):

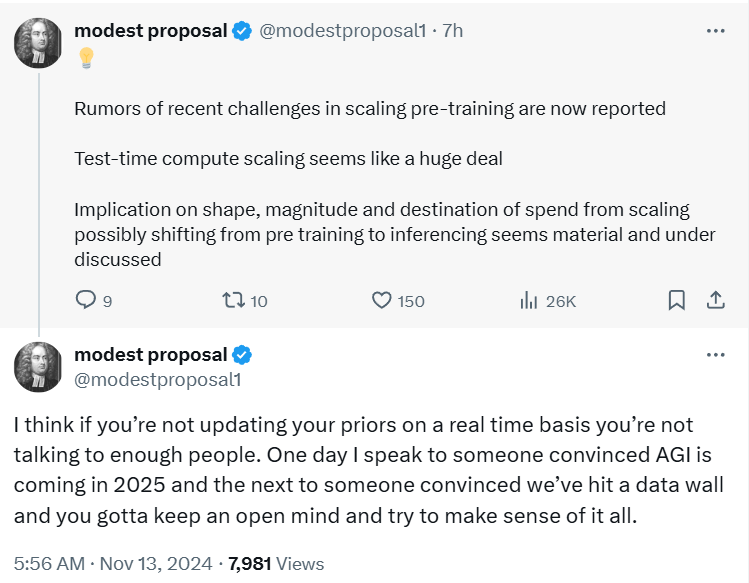

Why the weakness? Well Trump Tariffs taking a front seat is one. Bloomberg hopped on the scaling fears train today following articles from TheInformation and Reuters over the past two days (all recommended reading if you’re a semi investor). What does this means for hyperscaler capex as we move into 2026? Is going lower the only option? If inference becomes more important than training, how does that affect NVDA’s moat given more competition in inference? I don’t have the answer to these questions yet nor does anyone. Strong opinions, loosely held comes to mind. NVDA print becomes even more important now. I liked these tweets from modestproposal:

This is all moving quick and it’s a beautiful time for those that have a flexible mind. These fast shifts always create a very fun trading/investing environment (and a lucrative one if one is able to move their mind/feet fast enough). Overall a vibrant and exciting time to be following Tech.

Software continues to rip as laggards catching a bid. Yesterday it was ADBE. Today it was the cloud consumption group with MDB +6%; DDOG +4%; SNOW +4%; CFLT +4.5%. Despite IGV putting in a gravestone DOJI today on the daily (which might mean some near-term digestion), we are feeling bullish over the next 6-9 months as we think sw will have its shot in the AI spotlight as AI agents/apps ramp as ROI use cases are easy to prove and before “secular seat risk” takes a front seat. After all, we have heard some cases of companies like Klarna ripping out CRM/WDAY to develop their own in-house solutions and we all know one of the best use cases of Gen AI right now is making it easier to code/create software. However, that’s a story for another day (later on in 2025 perhaps). For the time being, we can enjoy the “golden 6-9 months of software” (not as a nice a ring to it as “golden age of software”). We think companies with large amounts of enterprise data like CRM, NOW, MSFT, HUBS, TEAM will be able to provide better ROI than smaller companies. As we mentioned above, things are moving quick and our view will adjust as they do (maybe its a “golden 2-3 months of sw” instead of our base case of 6-9 months, maybe longer, who knows! that’s the exciting part!)…We’ll see what the large LLMs offer in therms of AI agents (Bloomberg saying OpenAI will launch some in Jan)…Other positives: Software companies don’t face risk from Trump Tariffs which is likely to be something we hear a lot about over the next 6-9 months and earnings revisions finally turning higher after 1.5 years of decline. A nice combo of top down and bottoms up tailwinds. IGV:

We get PANW, INTU, and SNOW next week.

Macro wise, treasuries saw mixed action with 2 year yields sinking 7bps while 10 year yields rose 1 bp as CPI came in slightly dovish. Odds of a Fed cut on 12/19 rose to ~80%. DXY continues to spike adding another 45bps. IWM underperformed down 1% while ARKK -2% BTC hitting some resistance at $90k. VitalKnowledge, as always, summarizes it well:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.