TMTB EOD Wrap

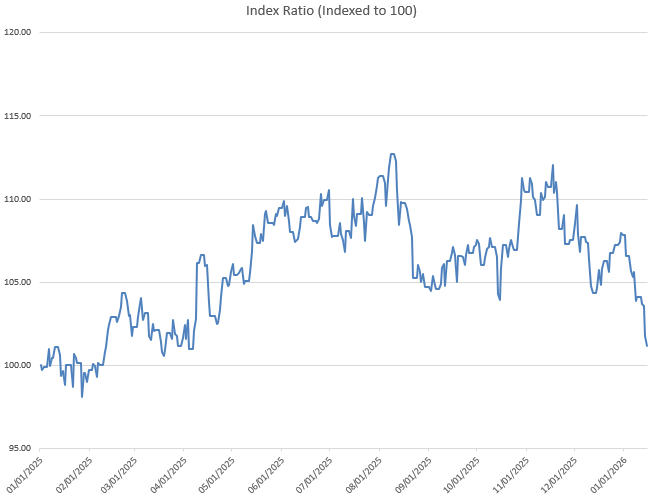

Good afternoon. QQQs +36bps as market struggled to find its footing outside of AI semis following TSM’s great print. IWM again outperformed QQQs, this time by about 50bps and has outperformed almost every day this new year with the ratio down ~6% YTD

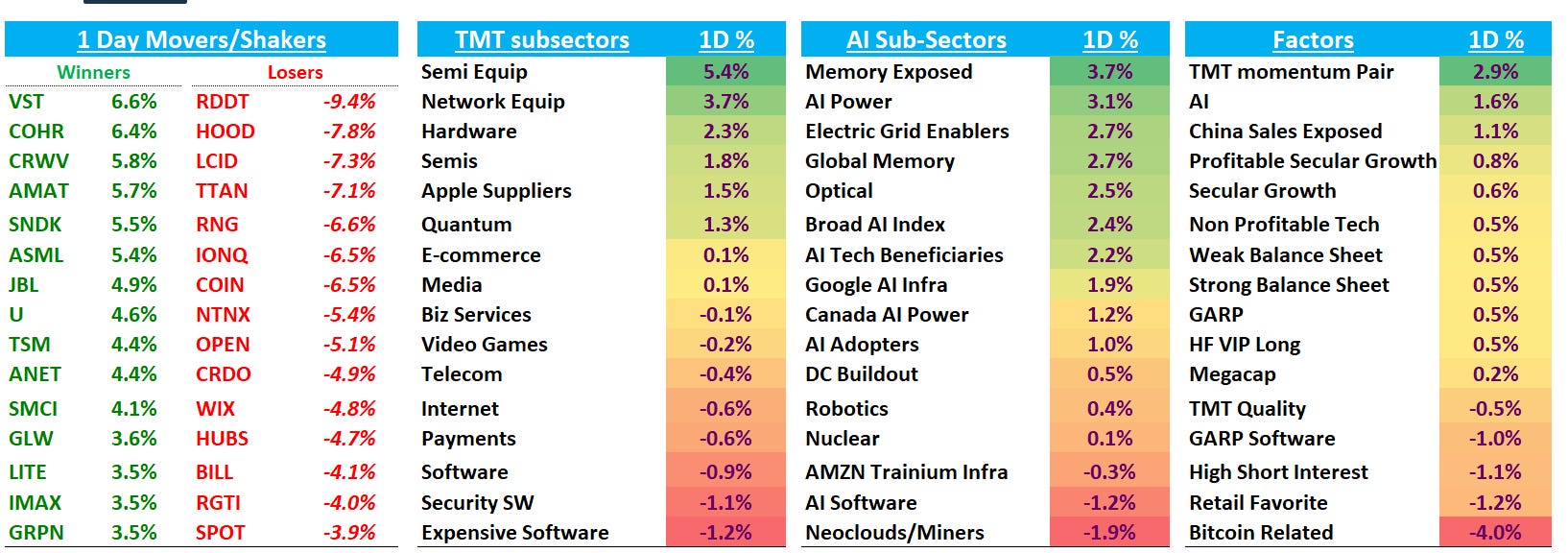

Broad AI risk on most of the day after TSM. Internet, payments, and software sold off, extending the semi vs. software rotation as investor conversations continue to focus on 2 key aspects of the AI trade: Claude Code and OpenAI. Factor-wise, TMT momentum, AI, and China-exposed tech worked, while quality and GARP underperformed. On the downside, high short interest, retail favorites, and crypto-linked names were hit hardest, with Bitcoin-related exposure notably weak on a Senate banking bill that felt hawkish for COIN/HOOD/CRCL (more detail below).

Treasuries saw some heavy selling with yields rising 2-6bps across the curve after some hot data and hawkish Fed remarks (from Schmid and Paulson). Fed expectations continue to shift in a hawkish direction with most still expecting June as first cut but expectations beginning to shift to July:

Let’s get to it…

INTERNET

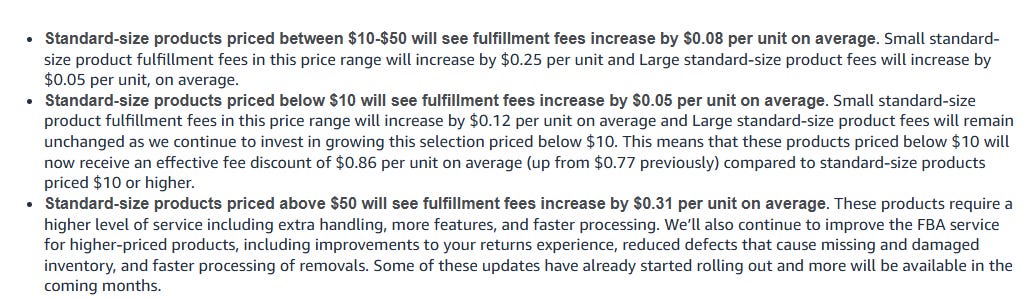

AMZN +65bps as I heard a 3p firm showed AWS tracking near 23% QTD although it’s only a little more than a week’s worth of data. Bernstein was also out positive with a $300 PT saying AWS and retail margins appear poised to accelerate. Raymond James was out with a more mixed noting saying Agnetic commerce is poised to breakout in 2026 and if AMZN were to go from “50%/40% purchase funnel share/eCom market share to 45%/39% eCom market share we think ‘core retail’ growth (1P, 3P, Ads) could be 1% below Street estimates that currently project 8% 2026 growth and potentially mix away from 3P/ads towards 1P/fulfillment with higher TAC.” Semianalysis had a note on Agentic commerce a couple days ago looking at it a little differently, saying Ai chatbots are now already 10% of all search traffic, which has caused about a ~2.5B share loss in CY25 for AMZN (which is very small vs. AMZN’s $750B in GMV). All in all, agentic commerce not great for the narrative, but still very small numbers. We’ll see how it evolves….After the close also saw that effective as of today, AMZN is raising fulfillment fees (based on simplistic assumptions, seems like could around 0.5-1% to op inc.):

RDDT -9% as RBC had weak checks saying feedback was weaker, citing low pricing, uneven conversion and limited near term impact from Max Campaigns. TechCrunch also reported that Digg launching a new Reddit which is now in public beta added fuel to the fire, as its news of a new competitor many (including me) didn’t know existed until today:

The reboot of the early internet online community Digg, a one-time rival to Reddit, is moving forward. The company, which is today back under the ownership of its original founder, Kevin Rose, along with Reddit co-founder Alexis Ohanian, is launching its open beta to the public on Wednesday.

Similar to Reddit, the new Digg offers a website and mobile app where you can browse feeds featuring posts from across a selection of its communities and join other communities that align with your interests. There, you can post, comment, and upvote (or “digg”) the site’s content. Before today’s public beta launch, the site offered 21 more generalized communities like gaming, technology, and entertainment, and was open to 67,000 users on an invite-only basis.

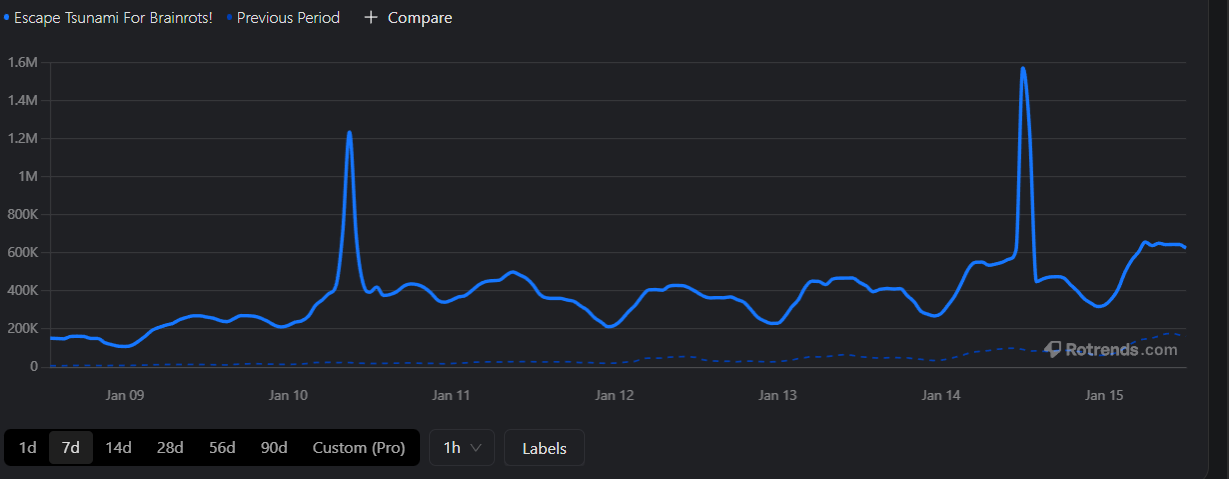

RBLX +2% as Escape from Tsunami continues to ramp in the charts (w/w about +300%)

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.