TMTB EOD Wrap

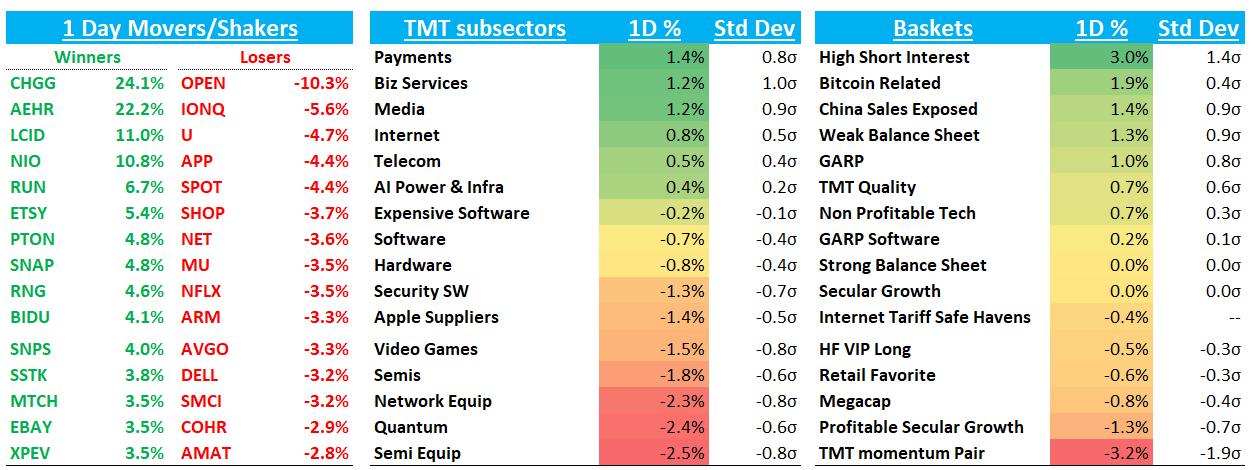

QQQs -52bps while SPX finished flat on a day where price action underneath the surface told more of a story than headline indexes. YTD laggards outperformed winners significantly today - from an individual stock perspective in Tech but also a sector perspective. For example, healthcare is down the most YTD and was +1.9% on the day while SOX which leads sectors YTD was down 1.7%. XHB (homebuilders) +5% — maybe those OPEN meme traders just early in calling the housing turn ;)…

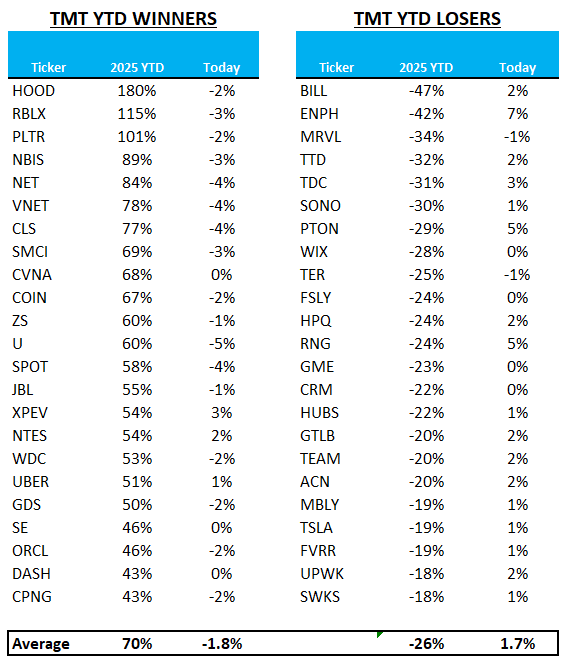

In TMT, YTD Losers outperformed winners by 350bps, a massive spread but for perspective the winners vs. losers spread is close to +100% this year:

Why the unwind? Investors are skittish as stocks have risen hard and fast and any piece of news - say, the ORCL WSJ article from last night- while without teeth enough to get some itchy trigger fingers on the sell button. Meme stock mania also causing some rotation away from popular longs and into highly shorted stocks that go up double digits every day (OPEN, CDLX, KSS etc.). Wait, KSS, as in Kohl’s? Yes that KSS. I had the same reaction you likely did….I’ve seen a few charts showing retail flows far from extremes, so maybe more to go here?

Yields ticked down 3-4bps although Fed expectations didn’t move much. BTC +200bps.

Post-close, TXN -7% as guide is a bit light of expectations (+4% at the mid pt vs buyside closer to 7-8% and EPS guide of $1.48 missing street at $1.51). Expects here were high going in as analog has rallied so these aren’t good enough.

SAP -3% on a decent inline print with CCB +28% vs street at 27.5% maybe a bit light of heightened expects given stock at highs. Looks down the middle of the fairway to us.

Let’s get to the recap…

INTERNET

GOOGL +65bps as Edgewater was out positive calling out a strong finish to Q2 saying no indication AI hurting paid clicks. Follows string of positive 3p reports over the last several days. Price action here remains strong ahead of earnings tomorrow.

ETSY +5.5% as RJ hiked PT to $70 on improving demand trends calling out improving web traffic, app usage and search trends to end the Q. DB also called out an overall strong Q2 and expects ETSY to guide to slight GMS improvement in Q3 as the platform benefits from more organic app-driven engagement and retooled product focus. This follows MS’ upgrade yesterday. 3p data continues to hover around flat y/y growth here with no real sustainable uptick yet.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.