TMTB EOD Wrap

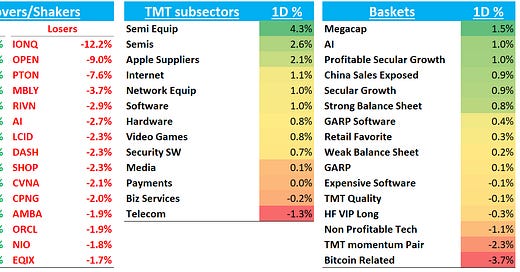

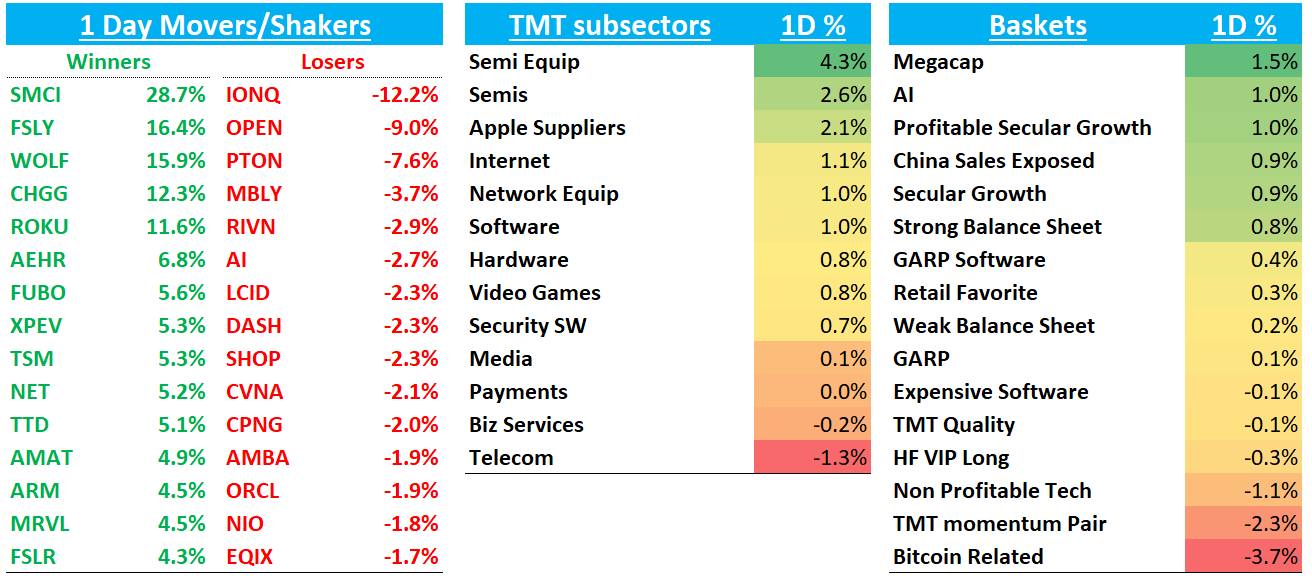

Good afternoon. QQQs +1.1% today as sems +2.6% outperformed despite NVDA +30bps underperforming the broader market on more rumors of GB200 pushouts, although they seemed bogus. Outisde of semis, megacaps outperformed today led by META +3% and MSFT +2%. AAPL is also sneakily hitting ATHs. Non profitable tech underperformed along with the IWM/SPY finishing roughly flat. BTC ticked down slightly now hovering around $95k.

Treasuries saw mixed price action with yields creeping up 1-2bps. The odds of a fed cut on 12/18 rose to 80% spurred by dovish remarks from Waller this afternoon, who said he was leaning towards a cut as inflation continues its downward. Outside of that, economy continues its “golidlocks” trajectory with strong BFCM sales, Nov ISM mfg beating and Atlanta’s Fed GDP tracker ticking up.

Post-close, MCHP -3% as the updated their guide to the low end of the range as the cut 500 heads. ZS - 8% as Q1 billings of +13% missed buyside at +14-15% and the rest of the year continues to imply a hockey stick which investors aren’t buying. CFO is retiring

Let’s get to the recap…

Internet

ROKU +11% / TTD+5% as Guggenheim speculated on a potential merger saying each company’s strengths and ambitions could be bolstered by a potential combo. Under such a deal, TTD could rapidly expand its operating system ambitions via ROKU’s streaming platform of 85M households while ROKU could leverage its viewer data and CTV inventory to meet growing ad demand. Didn’t think this note would move and unlikely this ever happens, but kind of makes sense to me.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.