TMTB EOD Wrap

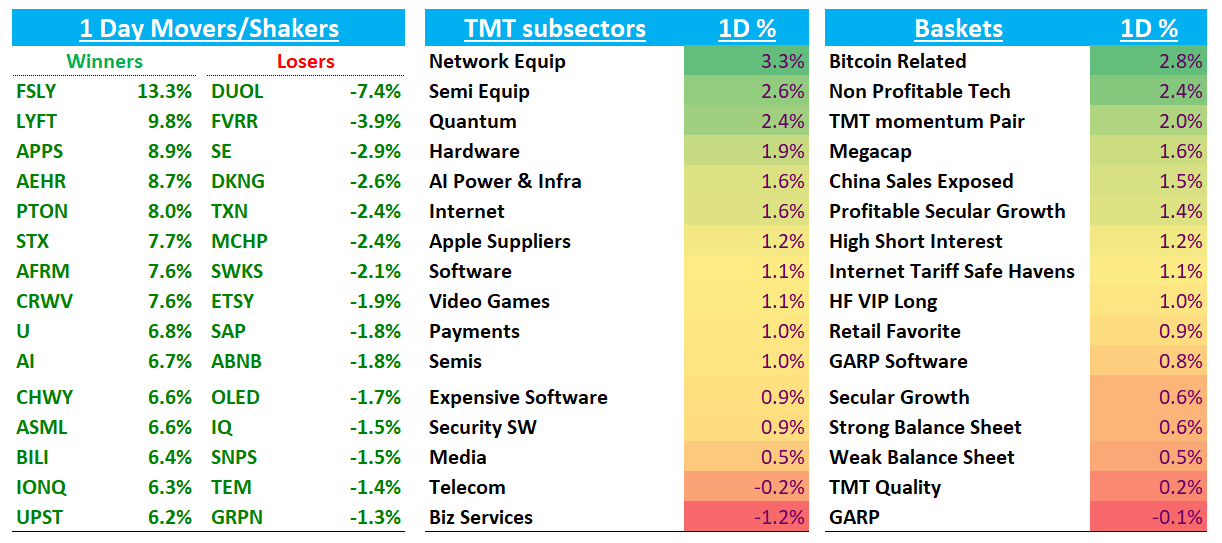

Good afternoon. QQQs +86bps helped by more positive AI news flow. Yields fell 1-3bps across the curve ahead of the Fed meeting later this week.

Let’s get straight to it….

INTERNET

GOOGL 4.5% as Gemini topped the app charts on the iPhone app store for the first time, helped by nanobanana image editor viral hit. What an amazing 180 company has done since flubbing the '“Bard” launch back in 2023 and being late to the chatbot game.

META +1.2% ahead of META Connect on Wednesday. TPBN will also have Zuck on Wednesday at 7pm pst. Specs/vid of the glasses were leaked here. We are believers of the glasses form factor and these look like they could potentially drive an inflection in adoption. We’ll have to wait for Wednesday for the full release. Checks continue to be positive on META intra q as revs look to be tracking 25%+ and Reels engagement continues to inflect higher. We think content/engagement growth on Instagram will be one of the biggest beneficiaries from increasing capability/adoption of LLM image/video models and their GPUs will deliver increasing ROIs for that engagement. Trump also posted about a TikTok deal being close.

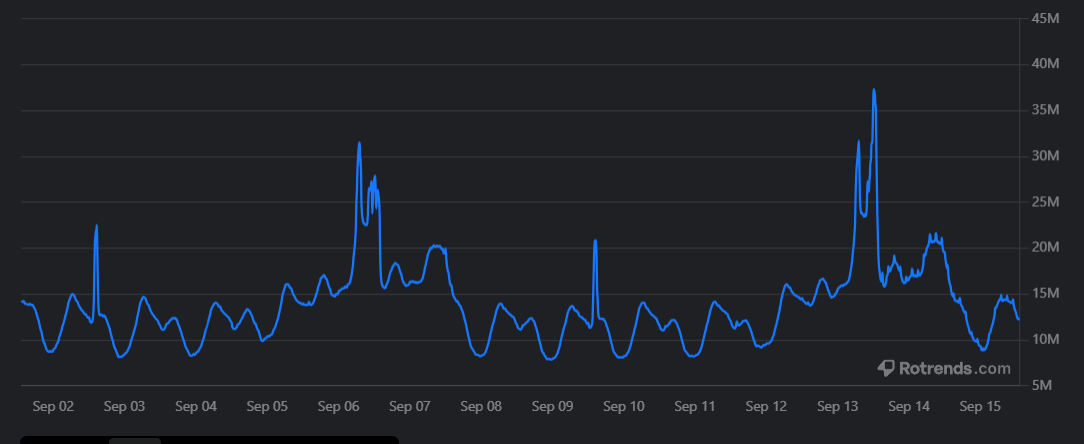

RBLX +3% as CCU data was positive over the weekend. Interestingly, Steal a Brainrot beat the peak CCUs from GAG, which just confirms how RBLX is doing a great job continuing to drive new games to become viral hits. CCUs so far about -20% m/m in Sept, which is about in line with seasonality - bookings still tracking to 60%+ y/y

AMZN +1.4% as Cowen was out saying that: after pulling back on colocation leasing, which we highlighted in our April channel checks, our recent checks confirm that Amazon has returned to the colocation market....says Project Raimer could be 7GW expansion, with close to 2GW coming online by EOY '26…another datapoint that helps support the AWS accel thesis in 2026

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.