TMTB EOD Wrap

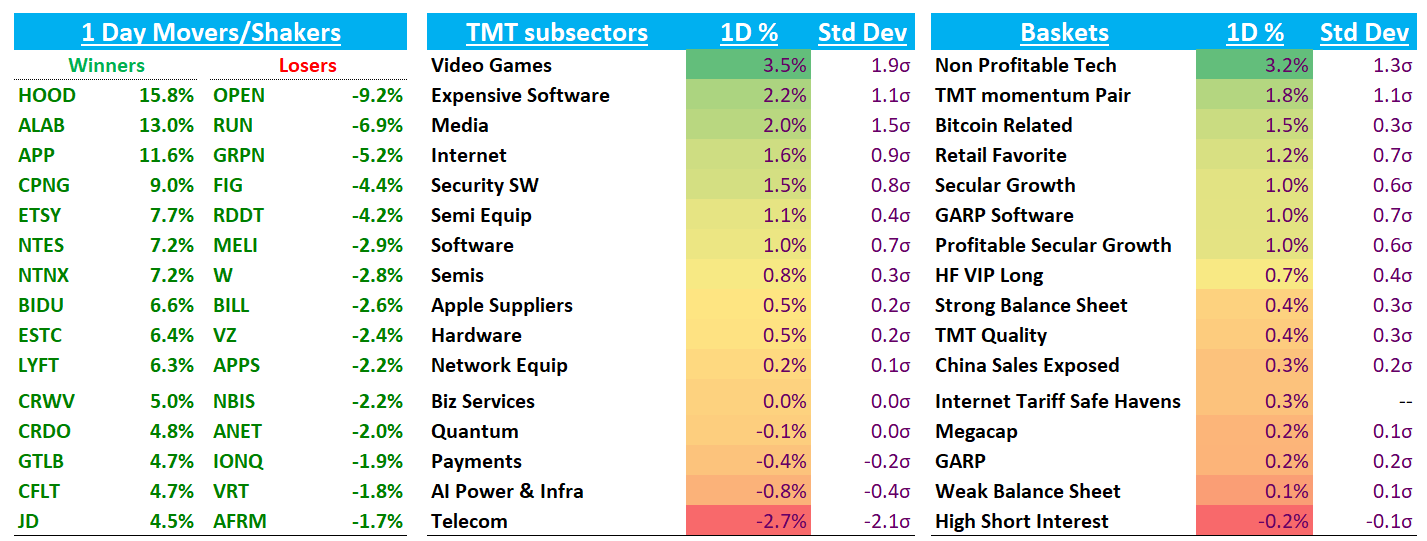

QQQ +50bps as yields extended losses from Friday, down 2-7bps across the curve. Fed expects continue to shift in a dovish direction now pricing in 29bps worth of cuts next week and 3 cuts for the rest of the year. Busy week got started with lots of companies presenting at GS.

For now, let’s get to it…

INTERNET

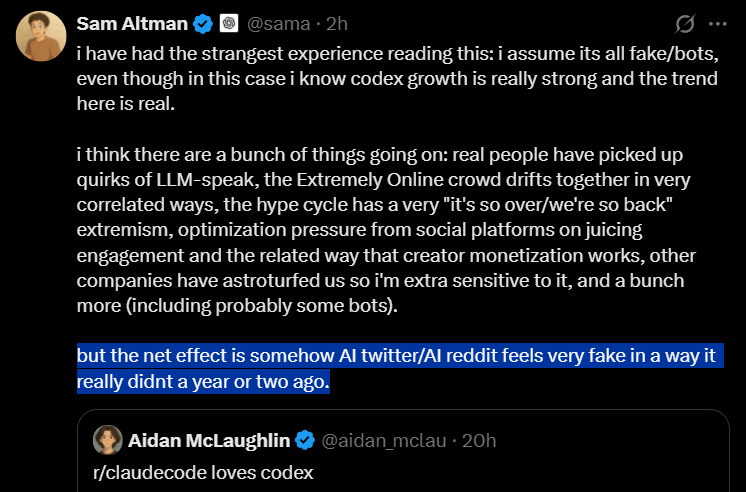

RDDT -4%: Lots of questions on this one, and not many great answers as stock sold off throughout the day. I think part of it attributed to some sell the news on stock not getting included in SP500 add Friday. Also heard some point to this post by Sam Altman, trying to defend a reddit post that said Claude Code is better..

Schilisky (Tech Spec at Citi) was also a bit mixed in his morning note, but not much new, just said stock more debated around $240 and pointed to fact mgmt said there might be some increased marketing spend to drive engagement. Rev checks positive and user data is fine - US DAUs tracking slightly below street but still up y/y and q/q. We’ll have to see how Sept ends up. Staying on our toes on this one - story sounds good and all, but if the data turns, then set up isn’t as clean. So far, still ok.

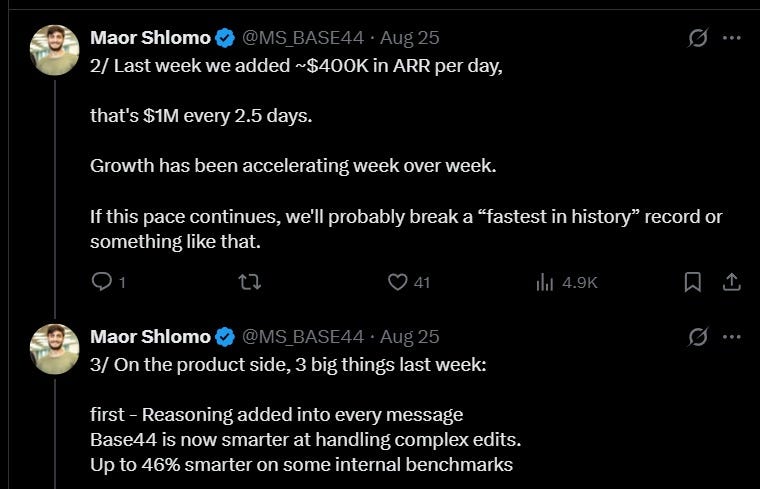

WIX flat after launching $750M convert. Lots of interest/talk in name recently given the Base44 acquisition, which is an Ai powered no-code platform. Basic story is this: co. bought the company in June for $80M and said it was on track for $40-$50M in ARR by year end. However, then CEO tweeted in late Aug they were doing over $400k in ARR every day

That’s a big number and implies over $1M every 2.5 days. CEO also said most of was coming organically before any Wix integration.

Now I always have my bullish hat handy and I’ve just put it on. Doing some simple math, if that pace continues, it would mean around $100M exit 2025 ARR, which is about 5% of WIX’s revenue. Street has WIX growing revs at 13% so that would be a massive boost to revs. If the pace continues through ‘26, it would add HSD growth and get WIX close to 20% top line growth.

Assuming that $400K per day of NNARR continues through 2027, that implies close to 400M in ARR. Loveable a vibe coding competitor just raised at 10x ARR, which implies $4B value (Wix mkt cap is only $8B). Yes, I know this isn’t a SOTP story, but my bull hat has taken over and is talking. TickerTrends had a good post on acquisition here in late Aug.

All these things help alleviate the view of WIX as an AI loser. Earnings were actually decent and co sounded good at Citi last week.

Not pitching the name, just relaying info and why stock has rallied 15%+ since the Base44 CEO tweet…

ETSY +8% as CEO was at GS - didn’t get a chance to listen in but heard sounded decent on overall demand environment, which was a relief as stock has been hit given concerns around 1) AMZN turning PLAs back on at GOOGL 2) TEMU increasing advertising and 3) De minimus going away. 3P data here mixed - seen some tracking 1-2 ppts ahead of streets, others less positive, but we don’t have much data from post-De minimus yet. Heard some rumors that de-minimus impacted companies have started shipping again.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.