TMTB: EOD Wrap

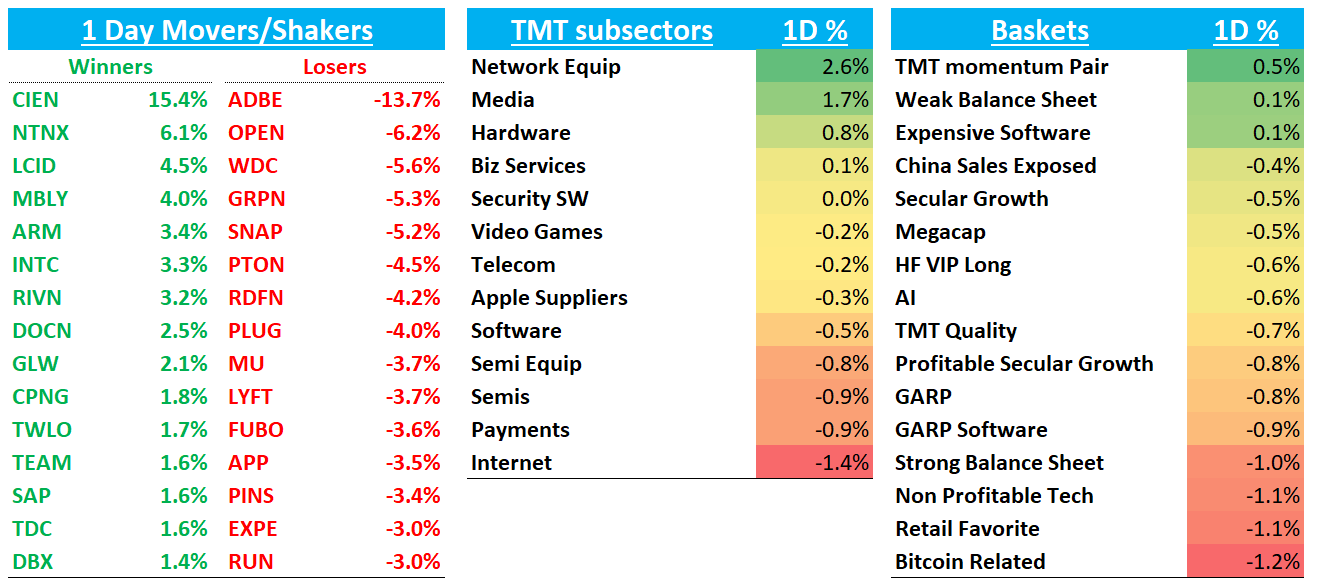

QQQs - 65bps as Semis -90bps, IWM -1.3% and ARKK -1.4% underperformed. igv DN 1% and now negative on the month as ADBE -14% followed ORCL and MDB in weaker than expected earnings. ORCL, GTLB and MDB look to be following through to the downside after earnings which to me continues to point to more digestion in overall software through the rest of the year (inline with mixed Dec. seasonality). The AVGO beat post-close might finally be the thing the shifts $ back into semis especially as we go into the end of the year - the group typically likes to rally into CES at the beginning of Jan.

MSFT CEO Nadella on BG2 podcast. Key quote getting passed around re: NVDA is they aren’t supply constrained on chips anymore (link to snippet)

BTC hovering right under $100k. Treasuries came under pressure w yields rising 5-7 bps across the curve. Odds of a fed cut on 12/18 stand at 100%, but focus will on the forward guidance next week as the market already assumes the 1/29 meeting will be a pause.

Let’s get to the recap…

Semis

WDC -6% as company was at Barclays sounding more cautious on NAND pricing than going into the quarter and saying pricing headwinds will continue into next q, although they talked up feeling good about being ready for the business spin. MU -4% in sympathy although I’d expect MU to rally a bit into the print as 1) AVGO just beat and usually next co. on the docket in the same space likes to rally and 2) Investors very much remember last quarter when all checks were weak yet MU still put up good numbers. Not on a call into the actual print, just wouldn’t surprise me if we get a bit of a rally into it.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.