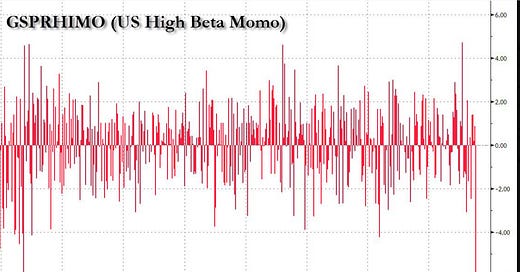

QQQs -90bps on a big momentum unwind day today, the 1D move in momentum in the past 2 years.

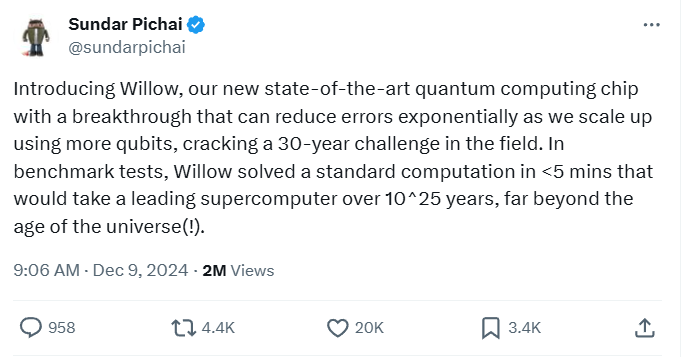

Saw YTD winners being sold and laggard being covered. Since momentum has become a bit of a Trump trade, also saw rep vs. dem basket underperform by more than 2 std dev.

What caused the reversal? Well, for one momentum has had a great run post-Trump and a lot of stocks were extended. The China dovish news driving FXI +8% causing some unwind as well. In addition, got some neg news on NVDA -3% (China news) and APP -15% (didn’t get added to SPX) that hit two of the biggest YTD winners. And then some BTC -3% weakness potentially exacerbated by GOOGL’s announcement of Willow:

Technological break-throughs make even competitors play nice.

Add on top of that some potential de-grossing ahead of CPI on Wed and we got a confluence of news items that might have triggered the reversal in momentum. It’s just one day but something to watch.

On days like today, we like to look at outlier strength in stocks that should be acting weaker given factor rotation (or vice versa). A few that stood out: 1) TSLA +15bps would have thought bigger drawdown given run and it being +10% in last couple days. Stock shook off a couple neg notes around deliveries last week as well so continues to act v strong 2) AAPL +1.5% - acts well on days when momentum does well and when it unwinds. Didn’t see any news today, but China big market for them 3) UBER -60bps can’t get a bid despite being a big laggard 4) AMD -6% got a downgrade today but exceptionally weak despite being a huge dog in semis 5) NOW only -30bps

Let’s get to the recap…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.