TMTB EOD Wrap

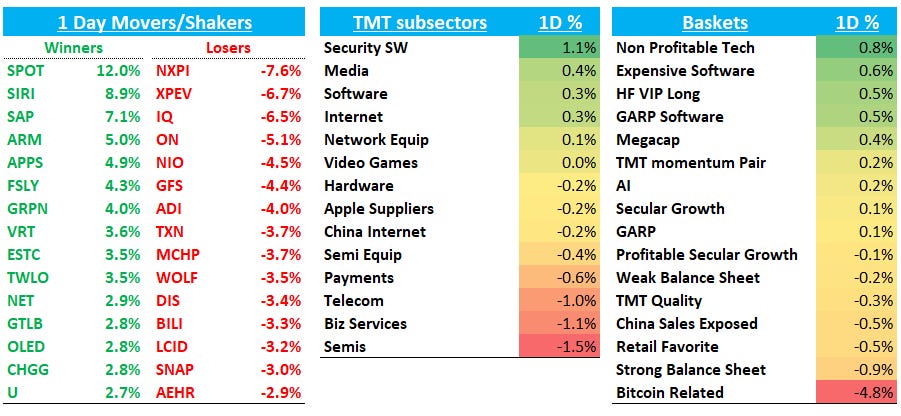

Good afternoon. QQQs -35bps; BTC - 3.5%; China -1.4%. Another day of IWM +1% outperformance as non-profitable tech outperformed.

Price action today pretty rationale on prints as beats worked even on consensus longs: SAP +6.5%, SPOT +12.5% and shorts down on bad prints: LOGI -3%; CMCSA - 5%; NXPI -8%.

Let’s get to it….

Internet:

AMZN +2%: Heard yip upticked on retail now tracking 1ppt above street in Q3 (impt given fears around Prime Day last wk) and that edgewater was positive on cloud growth

SNAP -2.6% as some de-risked ahead of GOOGL despite MS’s upgrade and Clev calling out strength in ROI Uptick & Better Ad Market Conditions offset by weakness in brand advertising; PINS -70bps

SPOT +12% after much better GM and profitability #s

ETSY -2.6% as Jefferies called out weak data in Q3 saying: “ETSY deteriorated to the worst decline since we started tracking traffic in '18”

TTD +40bps as GOOGl decided to get rid of cookies

GOOGL flat ahead of the print

CVNA +20bps as Jefferies called out positive…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.