TMTB EOD Wrap

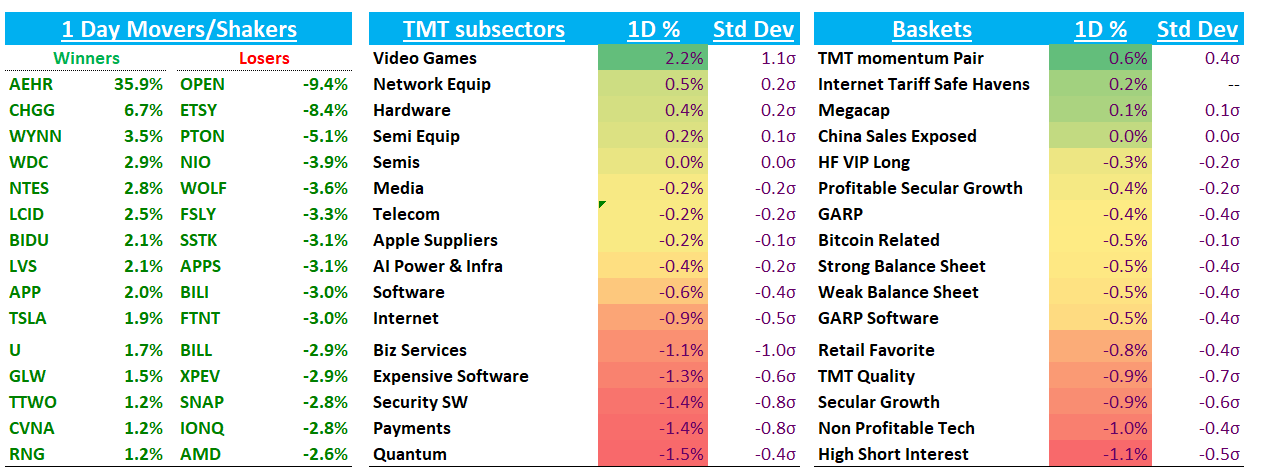

QQQs - 30bps with a mini late day swoon. Bulls were hoping for more follow through today post-Powell on Friday but it turned out to be a pretty sleepy August Monday. Momentum outperformed non profitable tech by 160bps. Yields rose 2-3bps across the curve. BTC -2% continues to slip following its false breakout earlier this month:

BTC led risk offsets off the bottom in Apr and typically leads the QQQs so something to continue to keep an eye on.

All eyes remain on NVDA on Wednesday. It wouldn’t surprise me to see some market de-risking ahead of the print over the next couple of days similar to what we saw in front of Powell last week — after all, Jensen, Powell, and Trump are on the Mount Rushmore of market movers.

Let’s get to it…

INTERNET

RBLX +6% nice move today after CCCs hit a new record this weekend, showing the viral power of the platform as the two top games - GAG and Steal a Brainrot and helping dismiss notions that the Schlep controversy had any negative impact on user growth.

NFLX +1% as Demon Hunters topped the box office charts in its limited run.

UBER -1.7% as Wedbush said “engagement and traffic trends QTD for Uber are tracking less positive vs expectations…On consolidated basis, app MAU declines of -1% Y/Y also slowed from +3% Y/Y in the prior quarter, primarily driven by a sequential deceleration in growth for the Uber app.”

SPOT +25bps as FT said SPOT signaled further price increases with their premium product, although the article didn’t reveal much new.

GOOGL +1% as investors continue to await the DOJ remedies decision — judge said “by late August” so one would imagine the decision comes this week.

DUOL -3% back under 20d as user data continues to slow and fears over AI impact on the business continue to grow. Stock still trades at 50x FY26 FCF.

ETSY -8%: All I saw was de-minimus ending this Friday. Maybe I missed something in PDD’s results related to Temu…

SNAP -3% as TheInformation reported SNAP has been discussing ways to raise outside money for its Spectacles project

RDDT +1% decent price action

W -6% as Trump said tariffs on furniture was coming

SEMIS

AMD -2.8% as Bluefin (semi boutique) said the Mi350 was running into qualification problems at xAI with thermal failures and weaker than expected performance. Bluefun warned that while AMD could still address the technical issues, setbacks increase the risk that xAI once again abandons AMD

STX/WDC +3% to new highs: Warming up to these names despite the big run (Yes, I know I’m late to the game, but I had tough time getting over previous view industry was sht…). @researchqf on X had a good thread here over the weekend on the names, with the simple takeaways being that storage players are some of the best ways to play the video on LLM theme - one minute video consumers 100x more data than one HD image (AI is not just a compute story, but a storage capacity storage). The rest of the 2 minute bull case comes down to this:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.