TMTB EOD, TTD First take

TTD (-25%) doesn’t look great with one of the smallest beats they’ve had at $493M vs $487M. The guide looks worse with Q4 Rev of “at least $580M” vs street at $610. Sees Q4 EBITDA about $270M vs $290M est. This comes on the back of increased expectations following APP + ROKU. Gripe here has always been valuation so should come down to earth after this miss.

Market recap:

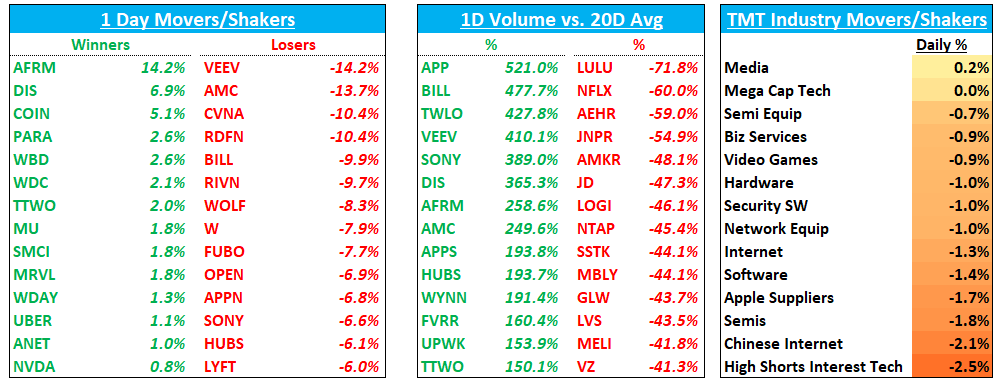

QQQs finished down 80bps and ARKK finished down 3% as yields popped 10-15 bps across the curve as some pointed to a weak 1pm treasury auction.

While it’s only one red day and the market had been up 9 straight days and overbought, I noticed some less than +ve action price today post earnings – definitely a change in character from the last couple weeks: no follow through from RBLX, APP and HUBS down after solid reports (although bears will pick on HUBS saying guide beat was fx driven. But given expectations one would have thought would be enough), LYFT dn 6%, TWLO flat on decent report even with low expectations going in, etc.) Not all was bad as DIS rallied throughout the day and UBER showed some follow through. Keeping a close eye as the tea leaves pile up…the one chart I’m watching as a key tell is ADBE, which has showed some of the best strength amongst large caps – will it hold above recent 52wk high resistance or fall below (so far, still fine…):

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.