As a reminder, we are closing access to NEW paid subs indefinitely end of day today and cracking down on sharing without paying. See our announcement here.

PLTR +12% looks solid with a rev beat and a guide slightly below street while EBITDA Q4 and guide much better. Given low expectations and underperformance, would think this is enough given good profit #s.

FY Guide:

Sees revenue $2.65B to $2.67B, EST $2.66B

Sees ADJ operating profit $834M to $850M, EST $760.3M

Sees ADJ free cash flow $800M to $1B

Q1 Guide:

Sees revenue $612M to $616M, EST $617.4M

Sees ADJ operating profit $196M to $200M, EST $170.9M

Q4 Results:

Revenue $608.4M, +20% y/y, EST $603.1M

Operating profit $65.8M vs. loss $17.8M y/y

EPS 4.0c vs. 1.0c y/y

Cash and cash equivalents $831.0M, -68% y/y, EST $1.75B

ADJ operating profit $209.4M, +83% y/y, EST $187.4M

ADJ EPS 8.0c vs. 4.0c y/y, EST 7.6c

ADJ EBITDA $217.3M, +79% y/y, EST $194.8M

ADJ free cash flow $304.8M vs. $75.8M y/y

ADJ operating margin 34% vs. 22% y/y, EST 31.1%

EOD Recap

Good afternoon. QQQs finished down only 13bps, but a lot of carnage underneath the surface as small/midcaps underperformed heavily following a continued bid to yields (1o year +15bps) and the China action overnight. ARKK finished down 2% while semis outperformed on the back of ON’s good results and NVDA/SMCI action. While we thought the price action in SMID land was decidedly negative, large caps still rallying on good news (see NVDA, GOOGL, AAPL, ON, UBER today). However, we did get a lack of follow through from META and AMZN so far.

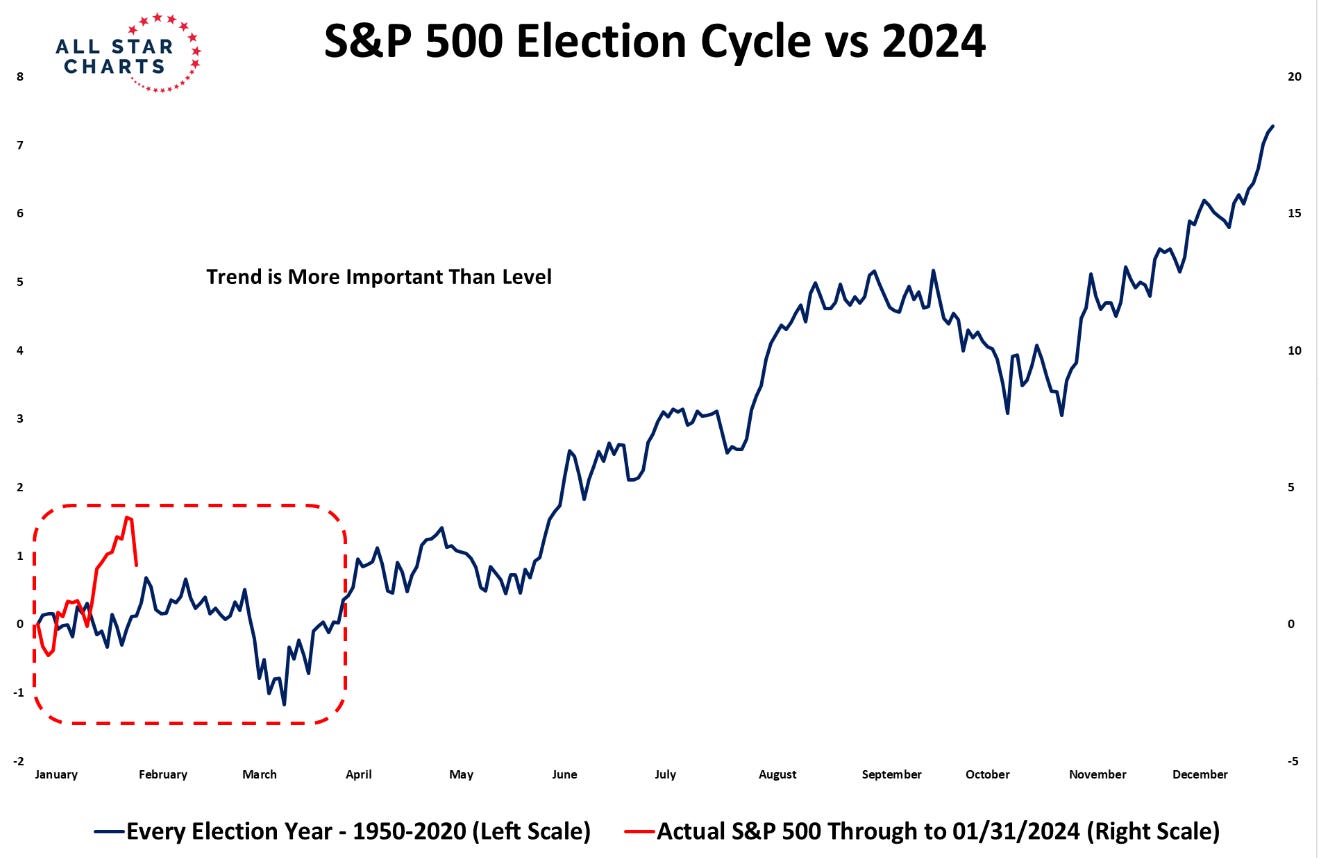

Could this be the start of a bigger pullback? It’s possible and we are watching closely. Two charts that have our mind’s eye attention is that the QQQs formed a short-term top last year post a blow out META print when the stock was up 20%+ (sound familar?) and the fact that we are heading into a seasonally weaker period in Feb (and Mega cap earnings behind us):

We’ll be watching closely for any other large cap tea leaves that tell us this could be part of a bigger pullback (AMD px action is another one)

In internet, GOOGL rallied 1% as news came out that Gemini Ultra could launch this week (link), which would be earlier than expected and news that Bard may be rebranded as “Gemini” while “Gemini Advanced” is also launching (paid tier based on Ultra.”) AMZN was down 1.2% on news that Bezos launched a 50M share sale plan through Jan 2025; although that news was out Friday, it was called out by several desks over the weekend. META fell 3%. SNAP dn 2% despite an RIF announcement, which raised hopes of better EBITDA #s and showed Spiegel wants to follow Zuck’s efficiency playbook. PINS outperformed other internet names only dn 50bps as Keybanc raised EBITDA numbers in their earnings preview. Lots of carnage in smaller names: housing names down with the rise in yields: Z -3%, OPEN -8%, RDFN -5%. MTCH down another 6% as investors continue to lack confidence in a turn in Tinder payer adds. Other notable decliners: ETSY -1.2%, ROKU -4%, RBLX -3%, TTD - 3%. China names were strong with BABA +4% ahead of earnings this week, JD +3% but PDD -3% as Trump called out" “upwards” of 60%” tariffs if he were elected. Other Trump related potential plays: does he go after TikTok again? (good for META); and Temu impact would be good for ETSY. UBER +1.3% on positive M-sci data.

In semis, SMCI continued its tear +15%! Now up 100% in a couple weeks - amazing. ON +10% following solid results and a better than expected guide vs. low expectations after many analog misses. Analog names up in sympathy: NXPI +3%, MCHP +1.6%, NVDA +5% as GS raised numbers and PT to $800 while AMD lagged down 2%. We wrote our thoughts on AMD vs. NVDA price action and catalyst path forward this morning:

Part of our bull case on AMD when we got positive in the fall was that the catalyst path was a lot cleaner for them as they ramped up Mi300 without having to worry about sustainability of demand concerns that were plaguing NVDA at the time. We have seen that play out with Asian checks showing a significant ramp up for the Mi300. However, the catalyst path for AMD has become a little murkier as you have had a big ramp up in expectations/checks and now NVDA will launch the B100 in March, which will likely precede checks/commentary about performance gap with Mi300 and a slew of positive checks as customers ramp up on the B100. So it’s not surprising to us that performance has begun to flip a bit….

GFS down 6% on JPM’s downgrade calling out potential downside to #s as some customers migrate to lower geometry nodes.

In software, CRM and ORCL led the way in the green both up a little under 1%. DOCU fell 8% as Reuters said Bain Hellman & Friedman have cooled their pursuit:

Bain Capital and Hellman & Friedman have cooled in their pursuit of DocuSign Inc over disagreements on how much they should pay to acquire the provider of online signature services, three people familiar with the matter said on Monday.

The private equity firms, which were competing to buy DocuSign, have not been able to agree a deal price with the company, which has a market value of $11 billion, after weeks of talks, the sources said.

We expected better price action out of U given Vision Pro hype, but small cap carnage didn’t spare it and stock finished dn 4% on the day ZS -5% on COO resigning as investors worried why the filling didn’t call out a reiteration of guidance. MDB was up 3% early and plenty of questions on it, but didn’t see any news and stock finished flat. PLTR -2% ahead of earnings.

Elsewhere, AAPL rallied 1.2% as Vision Pro hype built over the weekend, positive mentions by BAML/Wedbush, news that Huawei was prioritizing AI chipset production and slowing production for Mate 60 smartphones (link), and some mixed/slightly positive commentary from Foxconn.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.