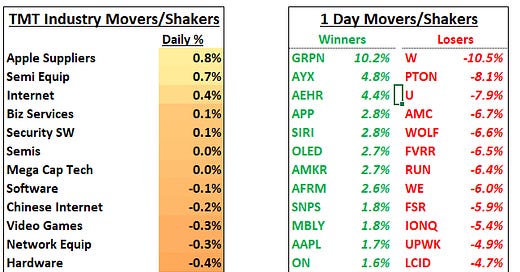

TMTB EOD: More dispersion in tech, Feedback on our $AMZN call, $AAPL leads large cap outperformance, Retail names weak, $Semis continue to struggle, $TSLA falls on number cuts

Good afternoon – another day in tech with heavy dispersion in names – as the QQQs finished up 10bps but $ARKK down 2.5%. Mixed day in treasuries, with 2-3 yields rising while the back end of the curve dipped. Crude was up 1.3%. Eco data was mixed as the important NAHB builder index sank below 50 for the first time in 5 months and the gov’t shutdown looked more likely than last week. Fears over student loan payments hit retail consumer names like $BBY, $GPS, $DG, etc and airlines fell on demand/oil fears.

Back to tech – large cap held up well today and was led by $AAPL up 1.7% on the back of +ve iPhone checks for the 15 pro max, which has a higher ASP and likely to drive better top line and gross margin, but checks were less positive on the whole for other models. Stock was rejected below the $180 level right at the 10D. Positive ad checks from BofA and ISI drove $META up 75bps and $GOOGL up 60bps. $AMZN underperformed down 30bps (we go into feedback on our ST take profits call …

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.