TMTB EOD

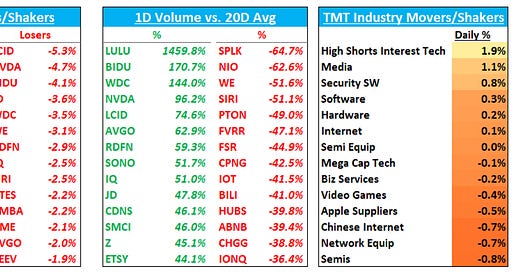

Good afternoon. Quite a crazy day in the QQQs at it seems the intra-day volatility is only increasing recently: QQQs sold off pre market on the back of higher yields as retail sales came in stronger and a round of negative individual news items hit causing the QQQs to fall as much as 1.5% early in the day before reversing to go green and finally finishing down 33bps. Overall breadth was good with equal-weight S&P, ARKK, and R2K all enjoying solid gains while some more popular names lagged. Yields spiked 8-16bps across the curve and fed expectations moved in a hawkish direction – the market is now placing 60% off on another 25bps rate hike happening (likely in Jan. while expects fell for a Nov hike). The DXY was flat and crude was up slightly.

In TMT, high short interest tech rallied up 2% and unloved names seemed to get a bid across different sectors. Semis underperformed on the back of more detail surrounding Biden’s chip restrictions and $ flowed into to software as a result, whi…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.