TMTB EOD

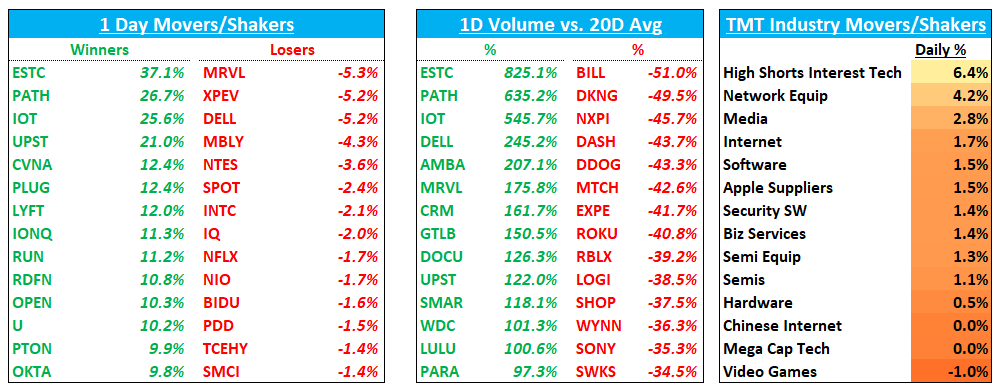

Good afternoon. The QQQs rallied mid morning to finish the day up 20bps despite large caps lagging again. We saw lots of highly shorted names outperform significantly today with many up double digits as yields fell 8-11bps across the curve (with the 2 and 10 year down 11bps and long end yields down less). Unloved sectors like network equipment and Media also outperformed. SOX finished in line with the QQQs but ARKK was up 5%.

In internet, yield sensitive names like housing were the big winners: RDFN +11%, OPEN +11%, Z +7% CVNA +13%. ETSY rallied 9% on better 3p data showing an acceleration in November and better BFCM #s. CHWY rose 5% despite weaker Yipit data which might point to sentiment being washed out as we head into their analyst day on Dec 14th. Other shorted names outperformed: CART +5%, MTCH +3%, U+10%. NFLX lagged down 2% (I must have missed something); META and GOOGL finished down 50bps. AMZN outperformed large caps on positive Yipit data showing NA and Int’l retail …

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.