TMTB EOD

QQQs dropped ~1% today. Unlike yesterday IWM underperformed down 2.5%, ARKK down 4%, BTC down 5%, and SOX dn 2%. SPY fell 80bps. Crude rallied 4% along with China up nearly 2% (Casino strength yesterday was the tell China might bounce back today). Treasuries rallied throughout the day and yields finished flat to down across the curve. It feels like many investors still finding their footing in the new year and there doesn’t seem to be a clear narrative that has taken hold: is the market beginning to price in something other than a soft-landing or is it just a bit of news void post a big rally to end last year (we lean towards the latter but we are still in “wait and see” approach to positioning)? The market is still assigning ~75-80% odds of a rate hike in March with 150bps rate reductions anticipated over the course of the year.

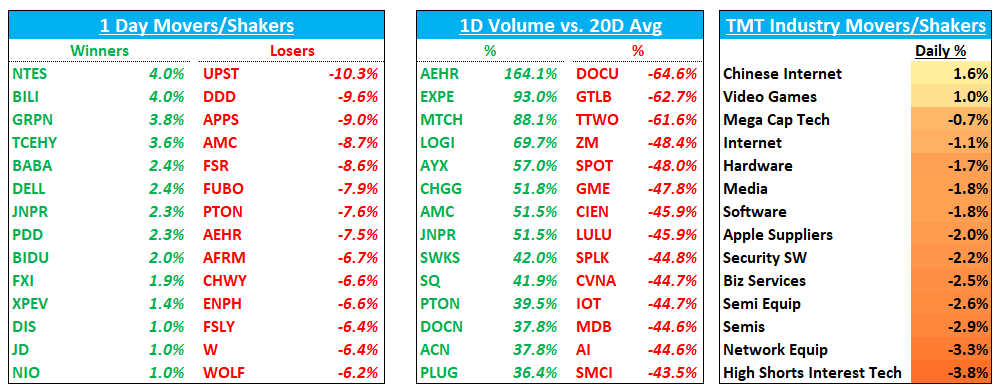

Internet and Mega Cap Tech outperformed while highly shorted stocks and semis led the way down. Not a lot of news flow yet, but we should begin to get earnings previews and more 3p data over the next couple weeks giving us some color on how the q finished up for some names.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.