TMTB EOD

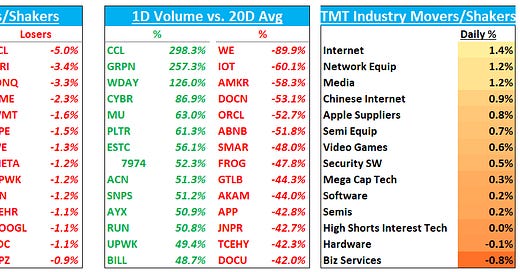

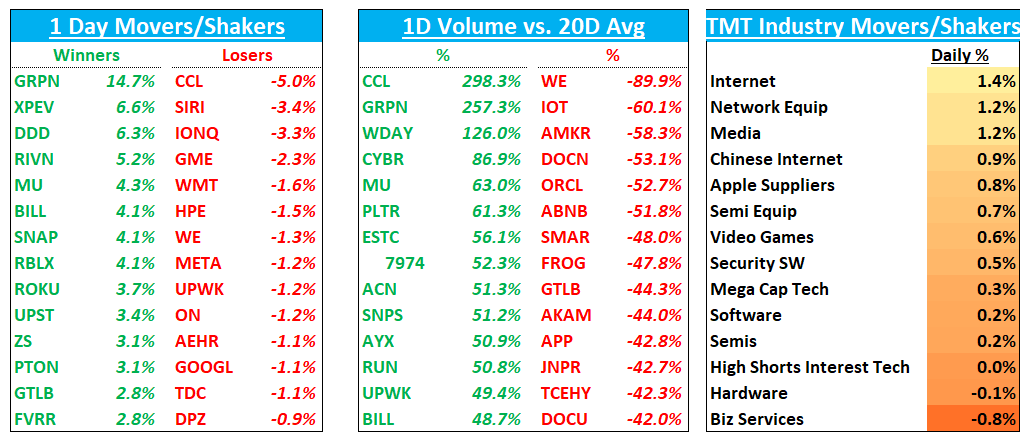

Good afternoon – some funky price action end of quarter. QQQs finished roughly flat with spoos down 26bps, after being up close to 1.3% at one point early morning on the back of better inflation numbers. ARKK outperformed up 1.4%, SOX up 40bps, China up 1.2%, crude dn 1%, and Treasuries were mixed, with 2-7 year yields dipping ~2bps while the rest of the curve ended unchanged. The dollar dipped 7bps, 3rd straight day of losses. Soime called out Fed’s William’s comments for the sell off – at first glance they sounded dovish but he mentioned he sees inflation of 2.5% all the way until 2025 – I think that’s more trying to find a reason for weird EOQ px action so take it fwiw. We continue to hold our view that the bottom earlier this week was a short-term low and that October will continue to see choppy trading action.

In TMT land, the two large caps that had held up the best these past couple of months – GOOGL and META – both underperformed finishing down more than 1%. AMZN finished…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.