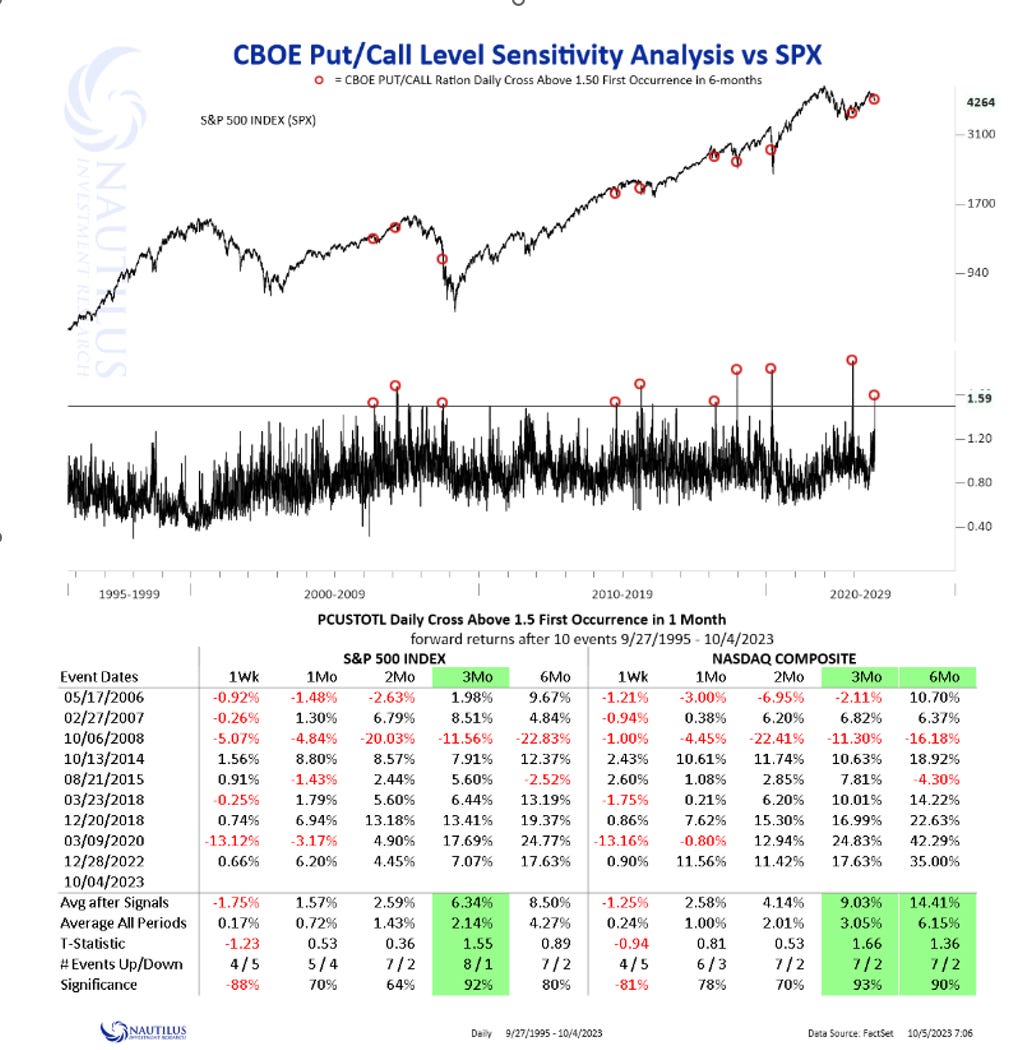

Good afternoon! Having fun yet? Another near-round trip for the QQQs finishing dn 30bps after being down 1.4% at one point as the market digested a weaker claims number in front of NFP tomorrow. Some out there pointing to put-call ratio above 1.5 for reasons to get bullish as its one of a several indicators showing sentiment has reached an extreme on one side. Here are returns after P/C hits 1.5:

Treasuries were mixed, with 2-10 year yields dropping 2-5bps while 20-30 year yields rose 1-3bps as the fed sensitive 2 year didn’t really move after the Daly remarks mid-day, which were cited for the intra-day jump, as she suggested that rate hikes are over. ARKK outperformed flat while semis slightly underperformed. For tomorrow’s job #, the Street is in print at +170K for Sept. From VitalKnowledge: “While the ADP number was subdued for Sept (+89K), other jobs indications for last month have been brighter, including the manufacturing ISM’s employment index (which jumped to 51.2 vs. 48.5 i…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.