TMTB EOD

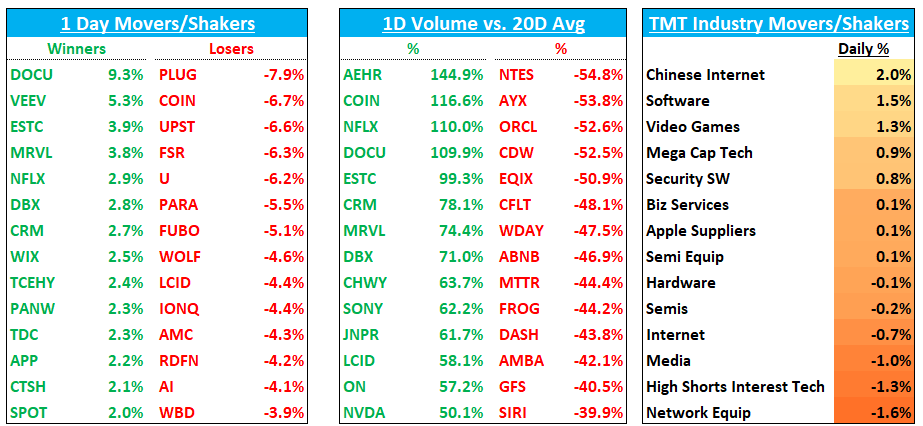

A bit of wild day for the QQQs - we sold off 1.5% from the open and then rallied another 1% after bottoming around noon to finish the day up 20bps. BTC finished up 1.6% on BTC ETP approval to finish at $46k (hit $49k at one pt), SOX was up 50bps, SPY down 10bps, and ARKK underperformed down 2.3%. Despite the slightly hotter CPI number yields finished the day down with the 2 year down 9bps and 10 year down 4-5bps.

In internet, NFLX was up 3% as Ad Chief said they had 23M AVOD subs, up from 15M in Nov. We went over our thoughts in this morning’s TMTB note. One of our readers kindly posted the news right after the interview concluded in our substack TMTB chat yesterday post-close and I had some good back and forth pre-mkt about what it meant for NFLX - I encourage you to check-in every now and then in the chat (and feel free to post!) if you aren’t yet, especially as we head into earnings season. RBLX +1.5% as 3p data showed an acceleration in DAUs through the first week of January and BTIG wrote up a positive note taking up bookings and EBITDA #s. AMZN +1% on the back of bullish notes by MS and BAML talking up margins and better AWS 3p data. CHWY +50bps on Barclays “Dog Days are Over” upgrade. SHOP flat as m-sci called out better Dec. data - I took profits on a good portion of our short-term long trade today, but still like the set up heading into the q. GOOGL down 20bps after announcing some engineering job cuts. ROKU down another 3% as investors continue to worry about AMZN Prime Video launch. EBAY down 2% on mixed 3p data. MTCH down 3% and now below where it was before Elliott announced a stake — I am hearing 3p data continues to look bad. LYFT flat on GS’ downgrade - we didn’t think the dg had too much meat and think a small long position on the name makes sense given easier bookings comps over the next couple months and headwinds to pricing which should begin to abate in Q2 - I am also hearing 3p data off to a good start in the new year (along w UBER). SPOT +2% getting close to new highs Chinese internet outperformed: BABA +1.4%, BIDU +1.2%, PDD +1.7%.

In software, DOCU +11% on news Hellman & Friedman are vying to buy it with Bain as a potential partner (or competing bidder?) - stock still not expensive at 4x FY25 EV/sales and buying software names at the first news of a potential PE deal has usually been a winner over the past year and according to the article the deal is supposed to go through in next few weeks. CRM +3% on Baird’s upgrade. ESTC +4.4% as Citi recapped a bullish mtg with CFO this past week and called out a resurgence in search, a differentiated position in GenAI and improving cloud consumption. CTSH +2% on Jefferies upgrade calling note better mgmt execution. U -6% gave back all of yesterday’s gains and more. NOW 1.5% on better Stifel checks. Sw security stocks up again: PANW +2.2%, FTNT +1.3%, ZS +1.4%

In semis, slow news day. MRVL +4% as mgmt continues to stay bullish. AVGO catching a bid again +1.7% and NVDA up another 1%. WOLF -4.5%, AEHR -2.2%, and ON -1.5% all underperforming post AEHR’s neg EPS earlier in the week. Heard chatter SWKS mgmt was suggesting they would not be surprised to see AAPL cut units, but BAML defended saying they did not extrapolate this from their meetings. BAML: “SWKS has no content lift this year. Apple units drive EPS, content drives PE multiple, and both are missing this year.” Stock was down 1%.

In fintech, sell the news reaction to BTC ETP approval as COIN -7%, MARA -13%, RIOT -16% all reversed after being up 5% early in the day. HOOD also down 3.5%. PYPL and SQ in the green up less than 1%.

Elsewhere, TSLA dn 3% on news they were announcing pay raises, HTZ selling 20k of their EV fleet, and halting output at Berlin on Red Sea conflict. PARA down 5%+ and WBD -4% on Redburn’s downgrades.

Bullish and Bearish YTD Option Flow

Source: RunningoftheBulltards

That’s all for today friends - remember to stay already happy! See you in the AM.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.