TMTB EOD

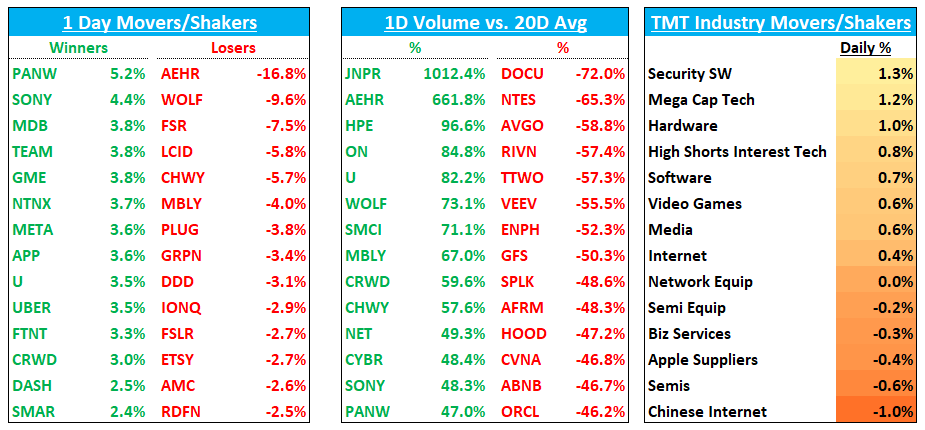

Good afternoon. QQQs finished +68bps as yields rose 1-3bps. Large cap outperformed while ARKK finished down 30bps and SOX dn 40bps. More new highs in individual names (NVDA, GOOGL, META, SHOP, DASH, CRWD, etc.) continue to drive the QQQs higher.

In internet, META was the big winner +3.6% as Mizuho laid out 3 catalysts in 2024 and raised their PT to $470 and positive GS mention (might have missed something else but that’s all I saw). DASH +2.5% and UBER +3.5% were strong, both hitting new highs. SNAP +2% on MS’ positive note, Speigel’s memo, and Wells positive preview shaking off some fears concerning Evan’s macro comments late yesterday. AMZN +1.5% as hearing retail 3p data tracking ahead of street so far — we get AWS 3p data tomorrow and we’ll see what that brings (it’s a tougher comp this wk, but gets easier going fwd). They also announced cuts at Twitch and Prime video which shows a commitment to margins and Cowen called out +ve ad checks. SHOP +1.2% new highs shaking off news of CRM/AMZN Buy with Prime integration. GOOGL +1% to 52wk highs as Cowen noted checks which called out an acceleration in search and YT to 17% from 13%. NFLX finished dn 1% despite +ve 3p data showing a beat to net adds and ARM this q and better AVOD uptake as Adweek had an article calling out AMZN Prime’s more competitive CPMs:

"Prime Video’s ad tier is on the way, and Amazon is trying to make advertisers and viewers an offer they can’t refuse…"Prime Video is coming to market with CPMs (cost per thousand viewers reached) in the mid-to-low $30 range, which is in line with prices for its Thursday Night Football inventory, according to two buyers with knowledge of the offering. By contrast, Netflix originally asked for a $65 CPM when it debuted its ad tier in late 2022, and HBO Max currently charges CPMs of between $33 and $53 for ads, according to Insider….It is far more competitive with some of the more established ad tiers and well below where some of the premium competition started at launch,” one buyer told Adweek, speaking on the condition of anonymity….Of course, that more competitive pricing is largely due to Prime Video’s massive scale, with the company projecting a reach of more than 100 million subscribers at launch, according to two buyers.

ROKU -2% presumably for the same reason as Prime Video loads the CTV ad market with supply (wouldn’t be surprised to see both ROKU and NFLX continue to underperform into Jan 29 Prime Video Ad launch although tricky as checks have been +ve on both). ETSY fell 2.7% on GS dg and CHWY was down 6%. RBLX dn 1% on 3p data release showing decelerating bookings in Dec (we wrote our thoughts up this morning). ZG down 1.5% on BAML’s dg. SPOT +2%.

In software, MS had a bullish note on sw security I missed this morning saying they expect a banner year driven by intensified attacks/global elections along with regulatory guidelines with SEC’s mandate for disclosing a material breach within 4 days. They think Gen AI is +ve for security spend as hackers are using Gen AI to create malware and more sophisticated phishing emails while increasing network traffic and driving new product releases. PANW was up 5%, FTNT +3%, CRWD +3%. NOW +2.2% as ISI called out strong checks. Other large caps were strong with MSFT +2% and CRM +1%. U bounced back +3.5% after being up 7% at one point.

In semis, NVDA continued its ascent +2.2% as FT reported Chinese companies repurposing NVDA gaming chips for AI in response to sanctions, suggesting strong China demand for NVDA’s regulatory compliant chips coming in Q2. AEHR fell 17% following their neg EPS announcement, bringing down WOLF -10% and ON -2%. MU followed through on yesterday’s Hynix news down 1% while TSM fell 1% on their Dec results which showed a deceleration although was on a much tougher comp. AMD underperformed down 50bps after a nice streak of green days. WDC rallied 2% (must have missed some Asia news here…)

Elsewhere, AAPL finished up 50bps shaking off a Redburn dg. SONY +4% as Japan market breaks out and 3p called out benefit from Fortnite renaissance. NTNX +4% and HPE bounced back +2% as investors got more comfortable with accretion math. TSLA dn 40bps on back of some weaker 3p data and weak auto semi datapts voer past couple days. PARA spiked mid day but fell 1% as WSJ reported Skydance CEO is discussing an all-cash bid for PARA’s parent, National Amusements with financial help and initial excitement was sold as investors questioned how much, if any, premium you would get in a deal.

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.