TMTB EOD

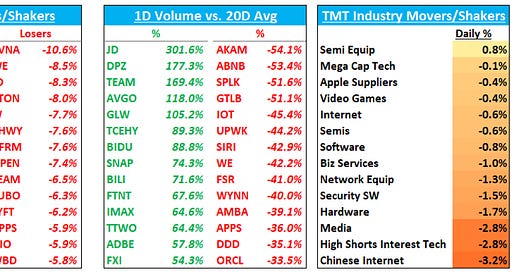

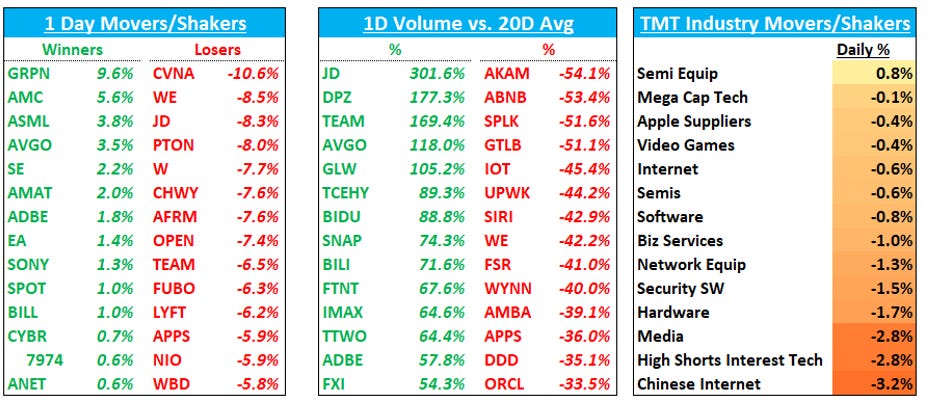

Good afternoon. QQQs fell 35 bps after a not so good bond auction took the indices down from their highs (were up 55 bps at one point as mkt had shaken off a slightly hotter than expected CPI). Treasuries fell and yields rallied 9-16bps across the curve and now sit near their highs. The dollar spiked 70bps. The brief respite we have had from yields and dollar headwinds that allowed equities to rally the last few days has now reversed and we’ll see how equities react in the next few days – we stick with our choppy October scenario.

Large cap tech was the big outperformer today and held the indices up. While the price action underneath the surface has been positive over the last two weeks in tech -- semis/NVDA outperforming, breadth beginning to expand, stocks rallying on downgrades – today I noticed some less than positive price action: I would have expected ETSY and EBAY to rally nicely on good 3p data, but they both failed to do so; PYPL and SQ both fell on positive notes from Barc…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.