TMTB EOD

AMZN falls on FTC suit, eco data adds fuel for the bears, META outperforms, NVDA the lone bright spot in semis, more consumer weakness

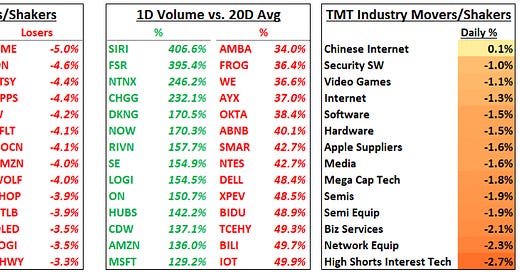

Good afternoon. Market red across the board today as heavy selling continued from last after a quick 1 day respite yesterday. The QQQs finished down 1.5%, SOX down 1.8%, ARKK down 1%, and Spoos down 1.4%. Crude finished up 1%. Interesting to note that the Russell 2K and equal weighted SPY are now flat YTD while SPX is up 11% and Nasdaq up 25% (h/t VitalKnowledge). Yields rose slightly, and dollar continued its ascent. Eco data added fuel to the bears today as US home prices ran hot (maybe shelter isn’t coming dn as quickly as some thought?), consumer confidence fell a few points and new home sales missed – all on top of weakening consumer surveys/datapoints (we pointed out Stiefel’s consumer survey this morning), heading into heavy treasury issuance, student loan repayments, China’s headwinds, gov’t shut down, UAW strike, a weak seasonal period, higher oil, etc. (wow, that sounds like a lot when I write it all down!). On the bright side for the bulls – sentiment has come down, posi…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.