TMTB EOD

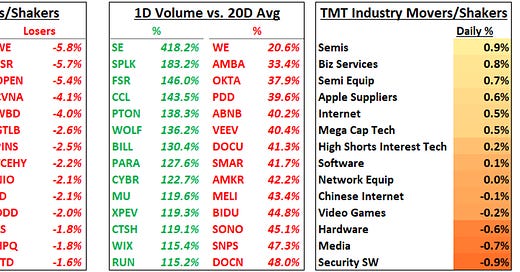

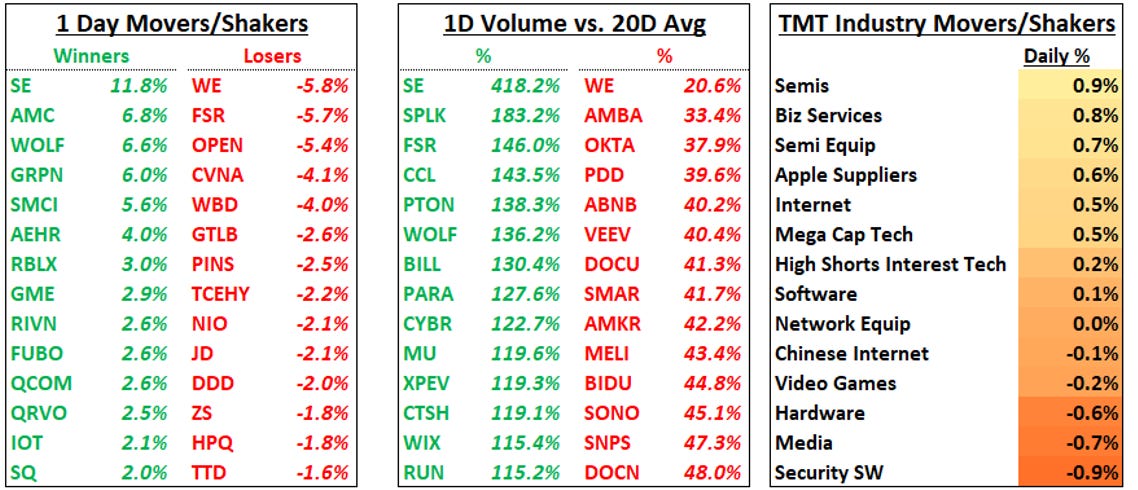

AMZN/NFLX outperform, Large cap helps the QQQs, Yields hit new highs, Semis performance improves at the expense of sw, GTLB falls on short report

Good evening – little late today on the recap as I was running some errands. QQQs finished up 47bps with SOX leading the way up 72bps and ARKK lagging at flat and China down 110bps. The dollar rose to its highest level since Nov (if the move continues, will likely be a headwind to tech topline and eps soon). Yields continued to climb especially on the back end – 10-year rose 11bps while the 30-year yield rose 14bps, even though Fed tightening assumptions still haven’t changed from Wednesday despite all the talk of Powell being hawkish (the year end ’24 rate remains at 4.7%). Breadth was mixed with more new lows than new highs but price action felt better today than last week.

We mentioned in our morning note that we thought a slew of individual positive news on large caps was likely to buoy the market and that’s exactly what happened. We recapped all the positive news on $AMZN - +ve cloud checks at ISI and Cowen, +ve Wedbush note on ad tier, and +ve news around their Anthropic inves…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.