TMTB: AMZN/META/AAPL Final thoughts/bogeys; ETSY Elliott; ZI ug at MS; T ug at JPM; NVDA sells chips to China; SHOP neg 3p data

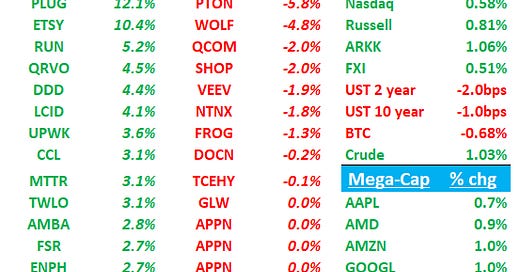

QQQs are up 70bps, Crude is up 1%, BTC dn 1% and yields slightly down post-fed yesterday. Early pre-mkt outperformance from IWM and ARKK so let’s see if that continues through the day today.

Slow research/news day today as we await the firehouse of earnings this afternoon from AAPL, AMZN, and META — we get into some final thoughts/bogeys below. News out this morning ETSY giving Elliott a board seat, driving stock up 10%+. Been hearing 3p data here getting less worse at the margins, Temu data getting incrementally less good, stock highly shorted, and with stock/sentiment at lows and stock at 10x EBTIDA, could see decent move today although some already questioning how much Elliott can do with ETSY and thinking it fades like MTCH. I think dynamics a little bit different and best guess is up double digits today.

Earnings Calendar:

AMZN/META/AAPL Final thoughts + Bogeys:

We wrote up our full previews for TMTB Pro Tier Subs this weekend here.

AMZN:

Final thoughts here: not touching my medium/LT long positions as we will believe in the bull thesis of 1) core margin expansion 2) accelerating aws rev growth 3) valuation that needs to play catch up.

In terms of short-term earnings trade, not sure I’ll be involved, butu lean long. Here’s why:

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.