TMTB: AMZN INTC First takes, mkt recap

AMZN Solid 1% beat to revs, op inc great at $11B vs bogey of $8.5B, AWS 12% growth.

Q4 guide below at $163.5B vs street at $166 and Op Inc q4 guide of $9B at mid point vs bogey of around $8.5B.

I mentioned in the chat I sold half of my long earnings position at $125 – solid print, but I’m nervous about what Q4 top line guide implies for retail/aws commentary so taking some off the table. If they imply 12-13%+ in AWS commentary, I think moves even higher, if it’s a more stable commentary, probably good enough given expectations. Op inc beat and guide confirms medium/long term bullish OI case.

We’ll have more thoughts after the call…

Details:

Net sales $143.08B, +13% y/y, EST $141.56B

Online stores net sales $57.27B, +7.1% y/y, EST $56.82B

Physical Stores net sales $4.96B, +5.6% y/y, EST $4.99B

Third-Party Seller Services net sales $34.34B, +20% y/y, EST $33.4B

Subscription Services net sales $10.17B, +14% y/y, EST $10.13B

AWS net sales $23.06B, +12% y/y, EST $23.13B

North America net sales $87.89B, +11% y/y, EST $87.12B

International net sales $32.14B, +16% y/y, EST $32.08B

Third-party seller services net sales excluding F/X +18% vs. +23% y/y, EST +16.6%

Subscription services net sales excluding F/X +13% vs. +14% y/y, EST +13.2%

Amazon Web Services net sales excluding F/X +12% vs. +27% y/y, EST +12.4%

EPS 94c vs. 65c q/q, EST 58c

Operating income $11.19B vs. $2.53B y/y, EST $7.71B

Operating margin 7.8% vs. 2% y/y, EST 5.46%

North America operating margin +4.9% vs. -0.5% y/y, EST +3.6%

International operating margin -0.3% vs. -8.9% y/y, EST -3.82%

Fulfillment expense $22.31B, +8.4% y/y, EST $22.14B

Seller unit mix 60% vs. 58% y/y, EST 58.6%

INTC (+7%) very solid print with better revs and gross margins…total revs $14.2B vs $13.6B driven by PC beat, datacenter a little light $3.8B vs street at $3.94B but in line with buyside expects. GM beat at 45.8% vs street at 43%

Q4 guide $15.1B at midpt vs street at $14.4, GM at 46.5% vs street at 44% and EPS at 44c vs street at 31cc

Inventory also good at $11.5B vs $11.9B

Print and guide should give more fuel to bulls that revs and GM are coming off cyclical lows.

Market Recap:

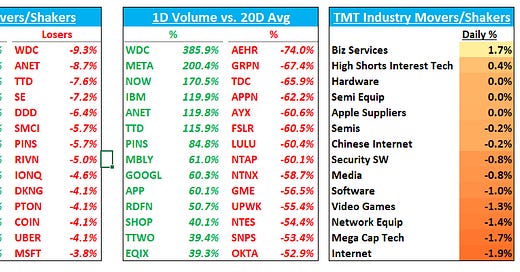

QQQs finished in the red again today down 1.5% ahead of AMZN’s earnings. Crude finished down 2.6%, BTC fell 2%, and treasuries were bid with yields falling 1-5bps across the curve.

Highly shorted names outperformed today while Internet, Mega cap, and thematic baskets like AI lagged.

We’ll do a quick round up today:

In internet, META fell 2.5% (was down as much as 6% at one point) as investors digested more top line uncertainty vs better costs efficiency: I have heard buyside numbers mainly in the range of $18-$21 today (we come out at around $19-20), which is sub 15x for one of the better stories in Tech. Ad names were weak on the back of META’s commentary: TTD was down 8%, ROKU was down 3% on the back of weaker Yipit data as well, and PINS finished down 6%. I guess Elon was onto something:

GOOGL another ad name that followed-through on their earnings yesterday as investors grappled with a r/r that isn’t so compelling on the back of increased top line uncertainty and less of a bull case around margins. NFLX fell 1.5%. SNAP was the lone ad outperformer up 2%. CHWY was the big outperformer up 6.5% - I’m hearing yipit live data has turned better for them in the month of October. Travel names EXPE ABNB and BKNG were weak on weaker 3p data calling out a deceleration in GBV in Oct for BKNG and EXPE. UBER and LYFT were also weak down 3-4%. SPOT following the trend of sell the good news as stock now back to where it was pre-report with another down 2% day.

In software NOW held onto gains up 4%. With MSFT only up 2% yesterday and down another 3.5% today (now below pre-print price), we view this as a good example of why positioning/expectations matter, even more so this quarter than others. IBM another example up 5% on an ok, but not stellar print. OKTA was flat on the back of an upgrade at Daiwa, a boutique while other sw security stocks lagged: PANW dn 3%, CRWD dn 2%, NET down 1.5%.

Semis outperformed with the SOX only dn 40bps. WDC was the big loser down 9% on news that Kioxia plans to walk away from the plan to merge NAND biz with WDC. Noted Bull J Klein @ Mizuho opines: “My sense is that if true, the lack of Hynix voting to approve on terms and likely wanting more equity or unfavorable terms is the breaking point. Hynix officially said last night they don't plan to vote for merger "under current plan." which sounded like pure negotiating tactic.

Now WDC stock down to July lows and well off the levels stock was BEFORE press talked about a merger in the works by yr end. Makes sense given limited liquidity in WDC and many won't own if no deal.” He still sounds positive on his thesis of better HDD demand and pricing. ANET finished down 9% and NVDA down 3% (briefly dipping below $400!) on the back of META’s capex plans coming in lower than expected. Other AI beneficiaries AVGO, MRVL and AMD were all down 1-3%. Wireless names outperformed with QCOM up 1% and SWKS flat. MBLY was the big outperformer up 8% on the back of a better report and UAW deal with Ford.

AAPL finished down 3% despite bid to semi wireless as no one wants to be in front of their earnings next week and big put flow came across the tape. TSLA finished down 3% as well.

That’s all for now – see you after the AMZN print.