TMTB: ADBE Recap; MU bulled at Citi/WFC; China auto semis; HPE Bernstein neg; RIVN ug at Piper; SNOW ug at Gugg; 3p Roundup (NFLX, SHOP, AMZN); DASH ug; GOOGL I/O May 14th; AMZN Sale;

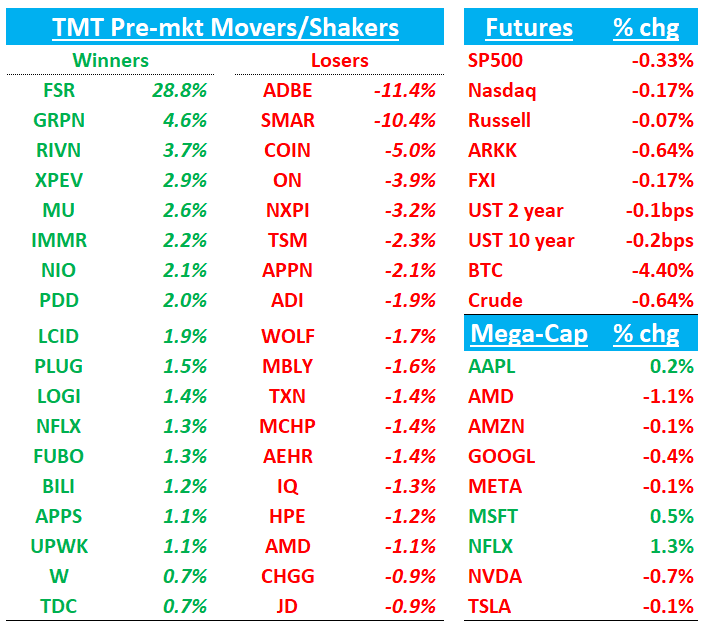

Good morning. QQQs are down 20bps as BTC is down another 4%. Yields are flat and crude is pulling back a bit. Opex today so could see some volatile action intraday. Let’s get to it.

ADBE: NNARR miss fuels growth/competitive concerns

ADBE missed bogeys for the 2nd straight quarter: Q1 NN ARR missed at $432M vs bogeys looking for $440M-$445M and guide at $410M. The upside to the guide was much lower than previous beats in the $45-$55 range over the past few quarters. Q2 NN ARR guide also missed at $440M vs bogeys around $475M and street at $469M.

Glass half full investors had left last quarter’s miss thinking that the $1.9B NNARR FY guide was just a starting point and conservative, and this miss puts a big dent in that view as buyside NN ARR numbers are coming down with buyside likely settling in at $1.9B-$2.0B for the year vs previous upside (and that includes a px increase this q). Investors also partly excused last quarters miss as a product of over-modeling the cc price incre…

Keep reading with a 7-day free trial

Subscribe to TMT Breakout to keep reading this post and get 7 days of free access to the full post archives.